UK-based Smarter Web Company acquires additional 230.05 bitcoins for $25 million

Smarter Web Company is expanding its BTC treasury strategy as more and more London-listed firms join.

London-listed companies are increasingly expanding their Bitcoin (BTC) treasury strategies. On Tuesday, July 1, the Smarter Web Company acquired an additional 230.05 bitcoins for $25 million. The move puts its total Bitcoin treasury holdings at 773.58 BTC.

The company revealed that the acquisition is part of its “The 10 Year Plan” to expand its BTC holdings exponentially. The last purchase came on June 24, when the UK-based web design firm purchased another 196 BTC.

The purchase is part of a growing trend where smaller companies are diversifying into Bitcoin to become more attractive to investors. Specifically, Smarter Web Company is originally a web design firm that has since moved into BTC.

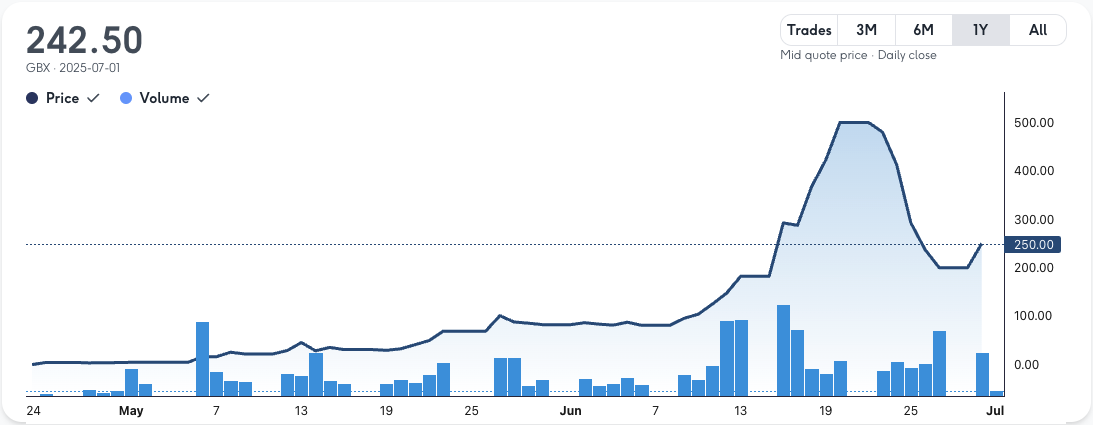

The strategy was successful, bringing its share price from £4.5 in April to a peak of £500 in June. Still, the firm has also shed 50% of its value since its peak.

London-listed firms join Bitcoin treasury race

Several London-listed firms are launching their own Bitcoin treasuries, irrespective of their core business. For instance, AI services firm Tao Alpha announced plans to raise £100 million from investors to buy Bitcoin.

Tech firms are not the only companies entering the race. Panther Metals, a natural resources company, announced that it had bought one Bitcoin. The firm’s shares were up 81% in June, despite it reporting a £2.2 million loss in 2024.

Bitcoin treasuries seem an attractive way for firms to make traders interested in their stock price. Still, according to FT, most of these firms are small-cap and loss-makers, with very small trading volumes. This means that their share price can take off very quickly. However, the firms are also susceptible to major corrections.

Ayrıca Şunları da Beğenebilirsiniz

Octav Integrates Chainlink to Deliver Independent Onchain NAV for DeFi

SEC Final Judgments on FTX Executives Filed