Berachain is online. How can holders increase their returns by staking BERA through Chorus One?

Author: Chorus One

Compiled by: Felix, PANews

Berachain mainnet is officially launched. This marks the beginning of a transformational period for DeFi, where security and liquidity can be scaled simultaneously under Berachain’s novel Proof of Liquidity (PoL) consensus.

Proof of Liquidity: The Foundation of Berachain

The goal of the Berachain Proof of Liquidity (PoL) consensus mechanism is to allow security and liquidity to scale simultaneously. In traditional Proof of Stake (PoS) blockchains, large amounts of capital are locked up to ensure network security. While this staked capital ensures network security, it sits idle and cannot contribute to ecosystem liquidity. The basic idea behind Proof of Liquidity is to eliminate the trade-off between security and liquidity by incentivizing DeFi activity with sustainable staking income.

Three-token model

Berachain’s economic design revolves around three different tokens:

- BERA: The network’s native token, used to pay gas fees and stake

- BGT (Berachain Governance Token): A non-transferable governance asset, earned only through liquidity provision

- HONEY: Native stablecoin minted through overcollateralization

Validators propose blocks and allocate BGT issuance based on their BERA Stake, which can be allocated to the reward vault. The issuance they can allocate depends on their BGT Stake: the frequency of proposals depends on their BERA Stake; how much BGT is allocated based on the proposal depends on their BGT stake. Users who provide DeFi liquidity can stake their receipt tokens in these reward vaults to receive BGT rewards.

Key applications powering Berachain

BEX: Berachain Exchange

BEX is a native decentralized exchange with House Pools and Metapools features to improve liquidity efficiency. Liquidity providers can not only earn transaction fees, but also accumulate BGT, which can be staked with validators to participate in governance and optimize emissions.

Bends: Native lending market

Bends allows users to borrow HONEY with collateral such as ETH, BTC, and USDC. By interacting with Bends, users can deepen liquidity while earning BGT, creating a dual incentive model for sustainable lending.

Berps: A native perpetual futures exchange that provides high-performance derivatives trading with deep liquidity and efficient capital deployment.

Introduction to BeraBoost: Optimizing Delegator Returns

With Berachain’s unique issuance mechanism, delegators need to develop complex strategies to maximize returns. This is where BeraBoost comes in - an automated allocation algorithm developed by Chorus One Research that dynamically optimizes BGT allocation to maximize returns.

How BeraBoost works

Validators on Berachain play a vital role in issuance distribution. Delegators who stake with validators benefit from the validator’s strategy of directing issuance to the reward treasury. BeraBoost goes a step further and achieves this goal by:

-

Issuance is distributed algorithmically to maximize delegators’ rewards on their Reward Vault positions

-

Transparently direct liquidity to where it is needed most

-

Automating the process of maximizing returns and reducing the complexity of staking for clients

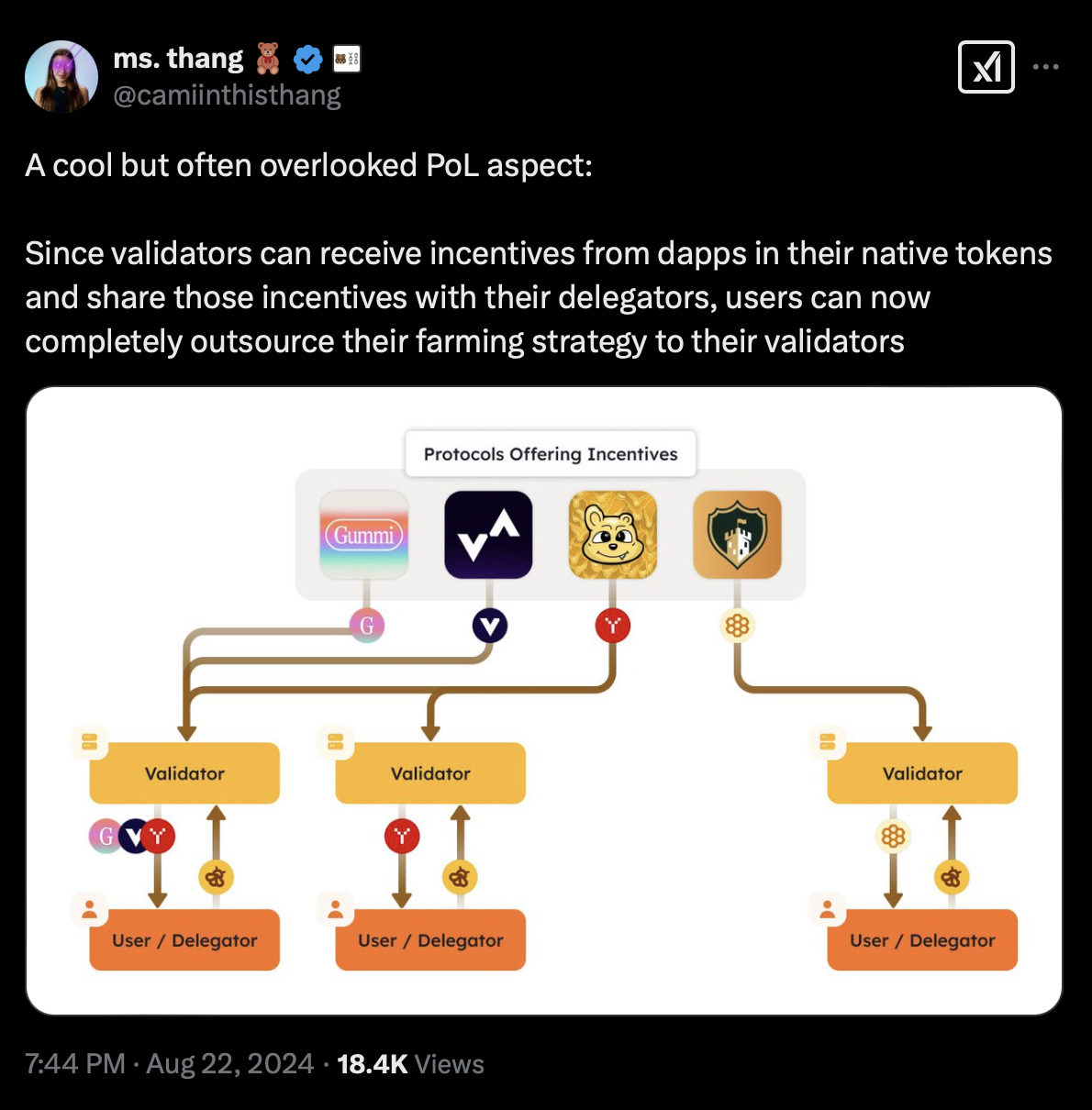

This mirrors how traditional DeFi yield farming strategies work, but integrates them directly at the consensus level. As Camila Ramos highlighted, Berachain’s PoL effectively allows users to outsource their farming strategies to validators, providing a way for both experienced and novice users to optimize returns without active management.

Learn more about BeraBoost here.

Why Berachain Pushes the Boundaries of DeFi Infrastructure

Berachain’s PoL brings a fundamental shift to blockchain economics. By combining security with capital efficiency, Berachain not only enhances validator incentives, but also promotes deeper liquidity for the entire ecosystem. The introduction of BeraBoost further refines this model, allowing delegators to passively maximize returns while strengthening the decentralized security of the network. With the mainnet live, Berachain is ready to redefine on-chain liquidity dynamics, governance participation, and validator incentives - while maintaining seamless Ethereum compatibility. Builders, liquidity providers, and institutional participants now have a powerful new platform to participate.

About Chorus One

Chorus One is one of the world's largest institutional staking providers, operating infrastructure for more than 60 Proof of Stake (PoS) networks, including Ethereum, Cosmos, Solana, Avalanche, Near, and more. Since 2018, Chorus One has been at the forefront of the PoS industry, providing easy-to-use enterprise-grade staking solutions, conducting industry-leading research, and investing in innovative protocols through Chorus One Ventures. As an ISO 27001 certified provider, Chorus One also offers slashing and double-signature insurance to its institutional clients.

Ayrıca Şunları da Beğenebilirsiniz

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

SEC approves generic listing standards, paving way for rapid crypto ETF launches