Bitcoin & Altcoin OI Forming Same Warning Setup As Dec 2024, Analyst Says

A cryptocurrency analyst has pointed out how the Open Interest for Bitcoin and the altcoins is forming a setup that previously led to a market downturn.

Bitcoin & Altcoins Have Seen A Jump In Open Interest Recently

In a new post on X, CryptoQuant community analyst Maartunn has discussed about the latest trend in the Open Interest for Bitcoin and the altcoins. This indicator measures the total amount of positions related to a given asset or group of assets that are currently open on all centralized derivatives exchanges. It takes into account both long and short positions.

When the value of the Open interest rises, it means speculative interest in the market is going up as traders are opening up fresh positions. Generally, new positions come with more leverage for the sector, so volatility can go up following a jump in the metric. On the other hand, the indicator going down implies investors are either pulling back on risk or getting forcibly liquidated by their platform. Such a washout of leverage typically results in greater market stability.

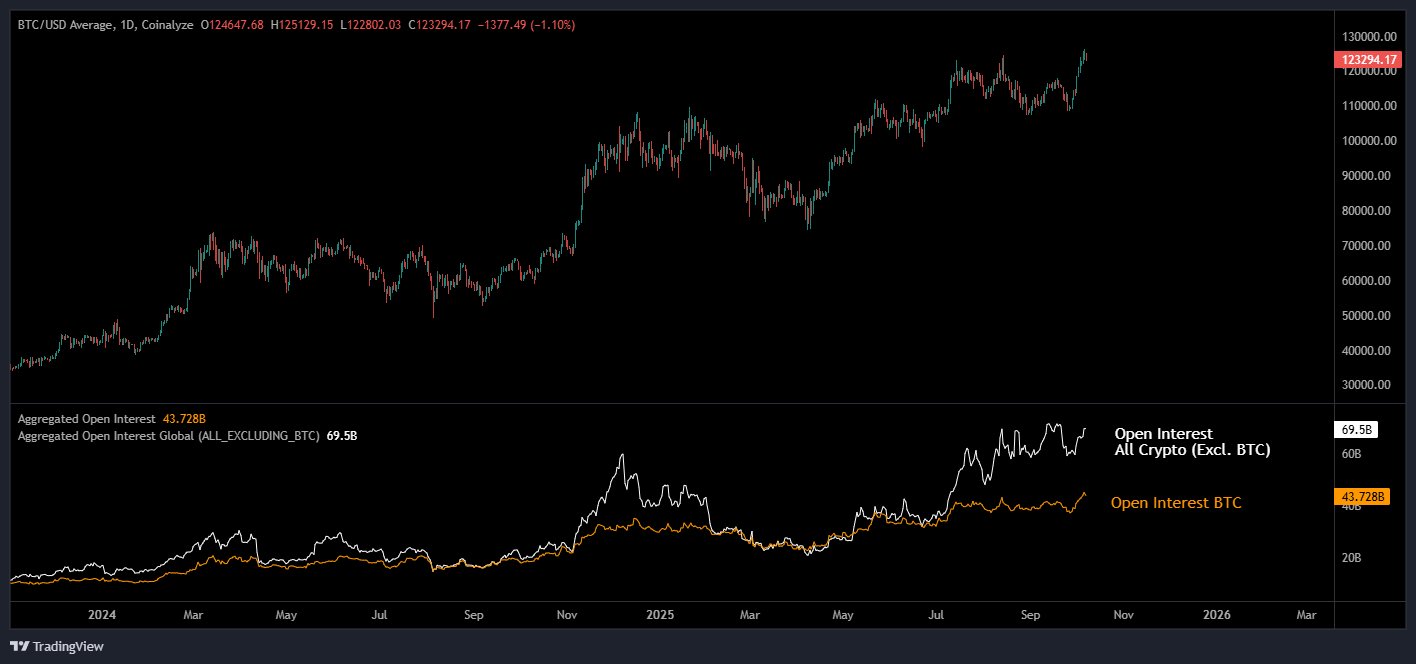

Now, here is the chart shared by Maartunn that shows the trend in the Open Interest for Bitcoin and that for all altcoins combined over the last couple of years:

As is visible in the above graph, the Bitcoin Open Interest has witnessed a notable increase alongside the latest price rally, implying investors have been opening up new bets on the derivatives market. This isn’t an unusual trend, as rallies tend to attract attention to the cryptocurrency, especially in the case of a run like the latest one, which has taken the coin to a fresh all-time high (ATH).

The scale and speed of the increase can be worth monitoring, however, as such conditions can make the market prone to a liquidation squeeze. Another factor that can be worth noting is that the altcoin Open Interest has also shot up at the same time, indicating speculative activity across the sector has ramped up.

From the chart, it’s visible that something like this also occurred in December 2024. “Back then, it led to months of sideways chop followed by a 30%+ drop,” notes the analyst.

The market could already be starting to feel the effects of heating in the Open Interest as Bitcoin and the altcoins have gone through notable volatility in the past day.

BTC plunged from above $125,000 to below $121,000 in the matter of a few hours, before recovering back near $123,000. Others, like Ethereum, are yet to make any significant recovery from the plunge.

This volatility resulted in liquidations of almost $644 million in the cryptocurrency derivatives market, according to data from CoinGlass.

BTC Price

At the time of writing, Bitcoin is trading around $122,900, up over 5% in the last week.

Ayrıca Şunları da Beğenebilirsiniz

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

![[OPINION] Honduras’ election turmoil offers a warning — and a mirror — for the Philippines](https://www.rappler.com/tachyon/2025/12/honduras-elections-december-17-2025-reuters.jpg?resize=75%2C75&crop=337px%2C0px%2C1387px%2C1387px)

[OPINION] Honduras’ election turmoil offers a warning — and a mirror — for the Philippines