Ether ETFs Extend Dominance With Another Half-Billion Inflow

Ether ETFs extended their momentum with a $523.92 million inflow, marking two days of extraordinary institutional demand. Bitcoin ETFs remained in positive territory with a $66 million net gain despite notable outflows from ARKB and GBTC.

Blackrock and Fidelity Drive $524 Million ETH ETF Surge As BTC ETFs Add $66 Million

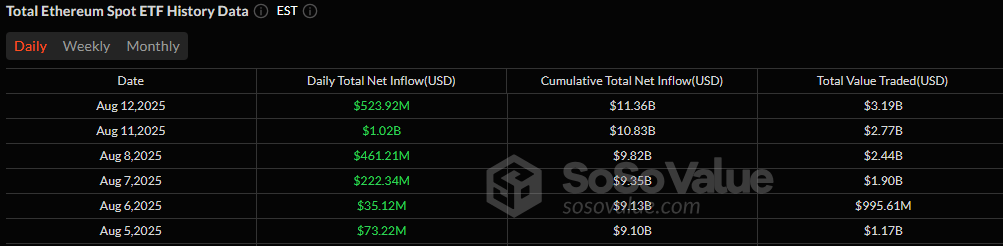

If Monday’s record-breaking ether ETF surge was a statement, Tuesday’s follow-up was pure confirmation that institutions want more ETH. For the 2nd straight day, ether ETFs posted massive inflows, raking in $523.92 million, while bitcoin ETFs saw a quieter but still positive $65.95 million gain.

Ether ETFs continued their institutional winning streak. Blackrock’s ETHA led the charge with $318.67 million, while Fidelity’s FETH added $144.93 million. Grayscale’s Ether Mini Trust brought in $44.25 million, ETHE added $9.33 million, and smaller boosts came from VanEck’s ETHV ($4.94 million) and 21Shares’ CETH ($1.80 million).

No outflows were recorded for the 2nd day in a row. Trading volumes hit $3.19 billion, and net assets jumped to $27.60 billion, nearly 5% of ethereum’s total market cap.

Source: Sosovalue

Source: Sosovalue

Bitcoin ETF flows told a more nuanced story. The entire inflow came from a single heavyweight: Blackrock’s IBIT with $111.44 million. But that was partly offset by $23.86 million exiting Ark 21Shares’ ARKB and $21.63 million leaving Grayscale’s GBTC. Even so, the day closed green, with $3.05 billion traded and total net assets climbing to $155.02 billion.

With ETH ETFs posting back-to-back blockbuster days and BTC ETFs holding their ground, the ETF race is looking less like a competition and more like a changing of the guard.

Ayrıca Şunları da Beğenebilirsiniz

XRP and SOL ETFs Attract Inflows Amid BTC, ETH Outflows

Exclusive interview with Smokey The Bera, co-founder of Berachain: How the innovative PoL public chain solves the liquidity problem and may be launched in a few months