Standard Chartered Bank Report: Is Solana Becoming a “Meme Chain” and Facing a Growth Dilemma?

Author: Adrian Zmudzinski

Compiled by: Tim, PANews

According to a recent report released by Standard Chartered Bank, Layer1 blockchain Solana may be evolving into a "single-function platform" focused solely on generating and trading Meme coins.

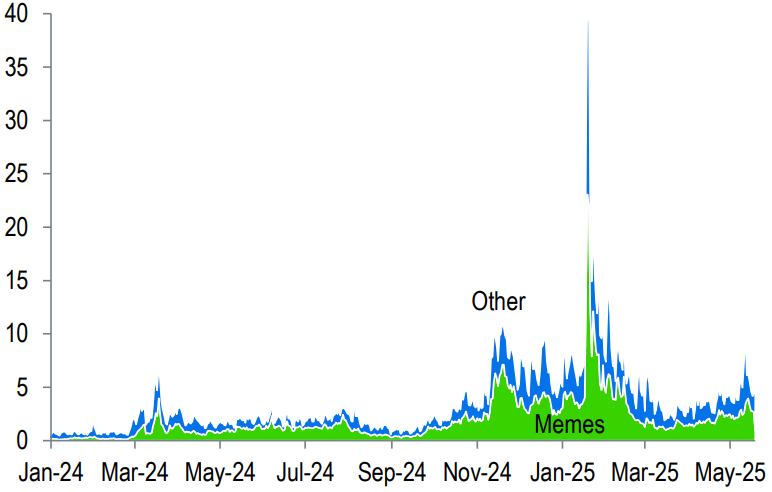

According to a May 27 research report, Solana’s dominance in the high-volume, low-cost public blockchain space is due to its fast and low-cost transaction confirmation design architecture, and this technical advantage has brought an unintended consequence: so far, this has been mainly concentrated in Meme coin transactions, which account for the majority of activity on Solana (measured by “GDP”, i.e. application revenue).

Standard Chartered Bank said the meme coin craze has put Solana’s scalability to a stress test, but the volatility and speculative nature of such assets also bring disadvantages. As meme coin trading volume declines, the bank warns that Solana may find it difficult to maintain its momentum.

Meme fever has passed its peak

The report pointed out that the Meme coin craze based on Solana has passed its peak, and the decline in usage and "cheap" transactions are not an ideal combination. The bank suggested that Solana should expand into other areas that require a large number of low-cost and fast transaction processing, such as financial settlement, decentralized cloud computing or real-time data exchange that require efficient processing of massive transactions. These areas are highly consistent with the high throughput characteristics of its blockchain.

Solana decentralized exchange trading volume. Source: Standard Chartered Bank

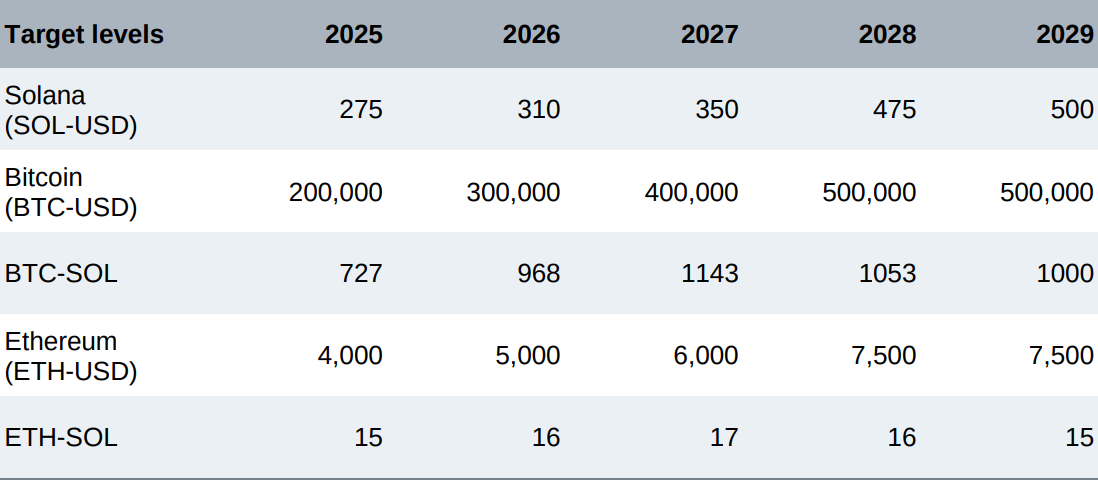

According to the report, these areas may include high-throughput financial applications and traditional consumer applications such as social media. However, the bank pointed out that the large-scale expansion of such applications may take several years, which will have serious consequences for Solana. If the progress is not as expected, its market competitiveness, developer ecology and platform reputation may be severely damaged, and its valuation may also face significant callback pressure.

“As a result, we expect Solana to underperform Ethereum for the next two to three years before catching up, at least in terms of real value.”

Standard Chartered's cryptocurrency price target. Source: Standard Chartered

Solana’s advantage is fading

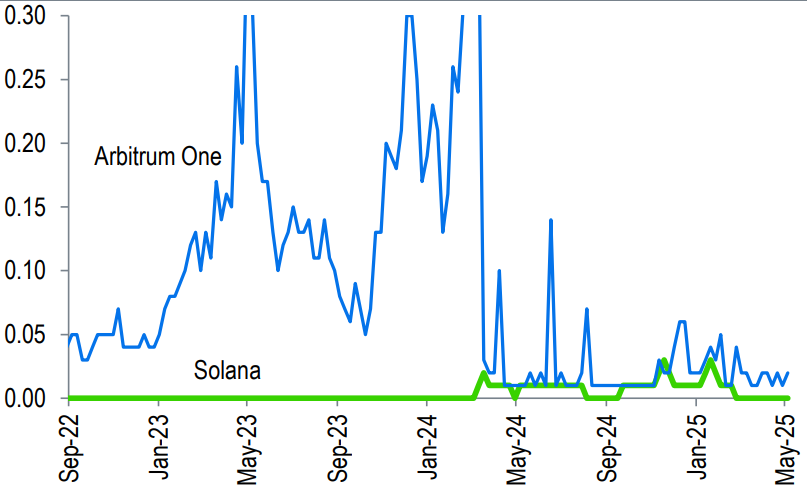

Solana has long positioned itself as a fast, low-cost, smart-contract-enabled L1 public blockchain, competing directly with Ethereum. However, this advantage may be waning.

Average transaction fees for Solana and Arbitrum. Source: Standard Chartered

Since the Dencun network upgrade in March 2024, Ethereum's second-layer platforms have surpassed Solana in average transaction costs. This shift puts pressure on Solana's value proposition as the "cheapest high-throughput blockchain." Standard Chartered Bank pointed out that Ethereum's modular design layers data availability, execution, and consensus, allowing for more efficient expansion while maintaining decentralization: "The modular approach enables Ethereum to scale transaction processing at low cost (after the Dencun upgrade) while maintaining the security advantages of a highly decentralized mainnet."

Ayrıca Şunları da Beğenebilirsiniz

Fundstrat’s Internal Report Contradicts CIO Tom Lee’s Bold Crypto Forecasts

SEC Backs Nasdaq, CBOE, NYSE Push to Simplify Crypto ETF Rules