When will Bitcoin’s decline end? Let’s wait and see if regulation breaks the ice and macroeconomics improves

Author: Bitfinex Alpha

Compiled by: Tim, PANews

Bitcoin's performance in the first quarter of 2025 was the worst in nearly a decade. Although the price soared to a record high of $109,590 at the beginning of the year, it still recorded a decline of nearly 11% at the quarter end. The market's initial optimistic expectations that Trump might win the election and implement pro-cryptocurrency policies quickly evolved into a textbook "sell the fact" market as substantive regulatory reforms were delayed. Since its historical high, Bitcoin has fallen to as low as $77,041, with a maximum retracement of nearly 29%. Since then, it has mainly fluctuated in the trading range of $78,000 to $88,000.

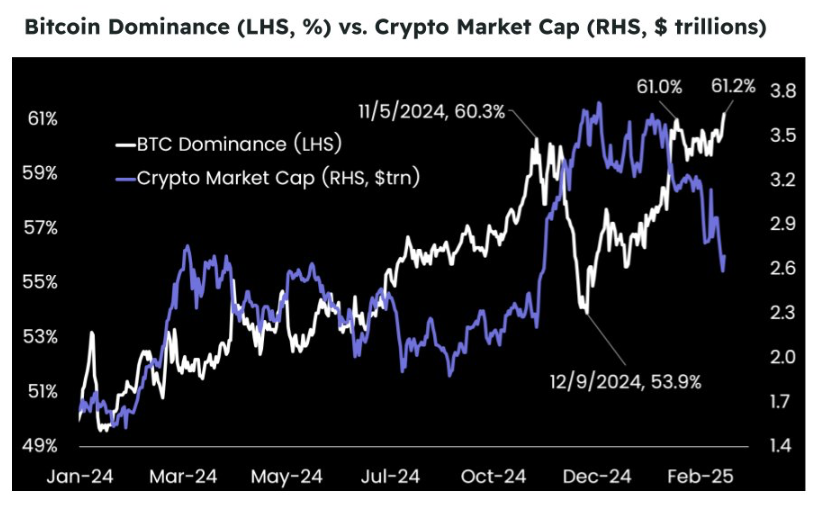

However, the market structure is still favorable for Bitcoin. Despite the sharp decline in the total market value of cryptocurrencies, Bitcoin's dominance has climbed to more than 61%, indicating that funds are rotating from riskier altcoins to Bitcoin in an environment of increased macro uncertainty. Altcoins such as Ethereum and Solana have fallen 35%-50% from their cyclical highs, further strengthening Bitcoin's position as a "reserve asset" in the crypto market.

As the second quarter begins, market price trends are still highly dependent on the guidance of macroeconomic signals, and the Fed's policy trends and ETF fund flows will continue to dominate the market direction. Although the current signs of panic selling by investors have eased, in an environment of continued liquidity tightening, the market still needs to wait for catalyst events with sufficient influence to form a trend breakthrough.

From the macroeconomic perspective, some areas of the US economy are showing resilience, such as a narrowing trade deficit and increased spending on durable goods, but these bright spots are overshadowed by deeper structural concerns. Driven by factors such as the new tariff policy that has pushed up import costs, inflation has accelerated beyond expectations. The core inflation rate rose 0.4% month-on-month in February, the largest monthly increase in more than a year, while consumer expectations show that inflation may remain high for a longer period of time.

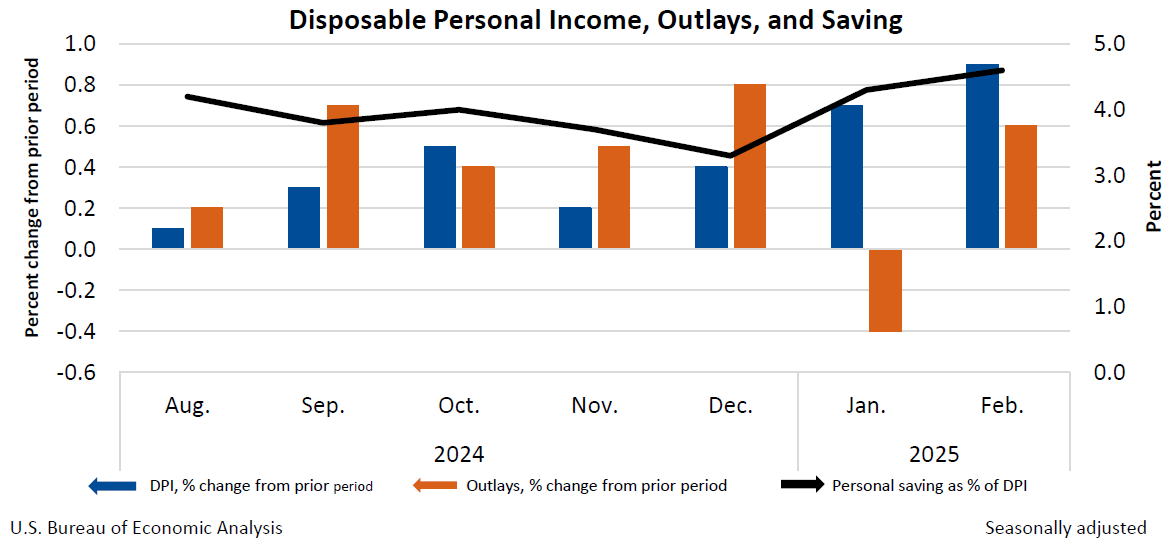

Personal disposable income, spending and savings

Meanwhile, economic growth is slowing. After deducting government spending, real income growth remains weak, while spending on services, a key economic driver, has begun to shrink. Consumer confidence continues to decline, with the Conference Board's consumer confidence index falling to a two-year low, and more Americans expect unemployment to rise. These trends suggest that households are becoming more cautious, as evidenced by the continued rise in personal savings rates.

Trade policy remains a core pressure point. Recent tariff increases and expectations of further measures in April and May are prompting businesses and consumers to adjust their behavior, including bringing forward purchases, delaying investments, or cutting back on hiring. Although the trade deficit narrowed in February, it followed a surge in imports in January, which may have been factored into GDP forecasts. As a result, economic growth is expected to slow significantly in the first quarter.

Despite the current economic uncertainty, the crypto industry continues to benefit from a friendly political environment, with the Trump administration pushing for increasing clarity on the regulatory framework and growing institutional enthusiasm for participation.

The U.S. Securities and Exchange Commission has officially dropped its lawsuit against three major players in the industry, Kraken, Consensys, and Cumberland DRW. This move marks the agency's shift from its previous tough enforcement regulatory stance to a more collaborative regulatory approach. It also indicates that the regulatory authorities will be committed to developing a clear and more constructive rule system for the cryptocurrency industry.

To further promote crypto regulation, the U.S. Securities and Exchange Commission's Crypto Assets Working Group announced that it will hold four special roundtable meetings from April to June 2025. These meetings will focus on core topics such as crypto trading regulation, digital asset custody, tokenization, and the future development of decentralized finance, and invite all parties in the industry to participate in the discussion. The event will be open to the public, which reflects the SEC's regulatory orientation of promoting open dialogue and enhancing transparency in the process of formulating cryptocurrency policies.

At the same time, Trump Media and Technology Group announced a partnership with cryptocurrency trading platform Crypto.com to launch a series of exchange-traded funds (ETFs) focused on cryptocurrencies. This move marks the group's official entry into the field of financial products, aiming to meet the market's growing demand for digital asset investment tools. Although the plan still needs to be approved by regulators, if it is successfully implemented, it will greatly enhance the visibility of Trump Media and Technology Group and Crypto.com in the traditional financial field.

Ayrıca Şunları da Beğenebilirsiniz

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

USD/INR opens flat on hopes of RBI’s follow-through intervention