Bitcoin Hyper Presale Explodes as Whales Pour $491K in a Week

The momentum speaks to something bigger than speculation. Bitcoin remains the undisputed heavyweight of crypto, but it still lumbers under severe limitations.

With only around seven transactions per second and fee spikes that have hit $100+ per transaction in busy periods, using Bitcoin as everyday money feels outdated. Compared to high-speed chains like Solana or even Ethereum’s scaling layers, Bitcoin looks more like a time capsule than the future of finance.

This is where Bitcoin Hyper ($HYPER) steps in. By giving Bitcoin a Layer 2 execution layer with sub-second transactions and near-zero fees, $HYPER positions itself as the bridge between $BTC’s “digital gold” narrative and the fast-moving world of payments, DeFi, and memes.

The Problem: Bitcoin’s Scalability Crisis

For all its dominance, Bitcoin ($BTC) still moves at a crawl. The base chain processes just ~7 transactions per second (TPS) on average – barely enough to handle a single Starbucks in a busy city.

Fees climb fast when demand spikes. During the launch of the Runes protocol in April 2024, the average transaction fee soared above $120, making everyday payments not just impractical but absurd.

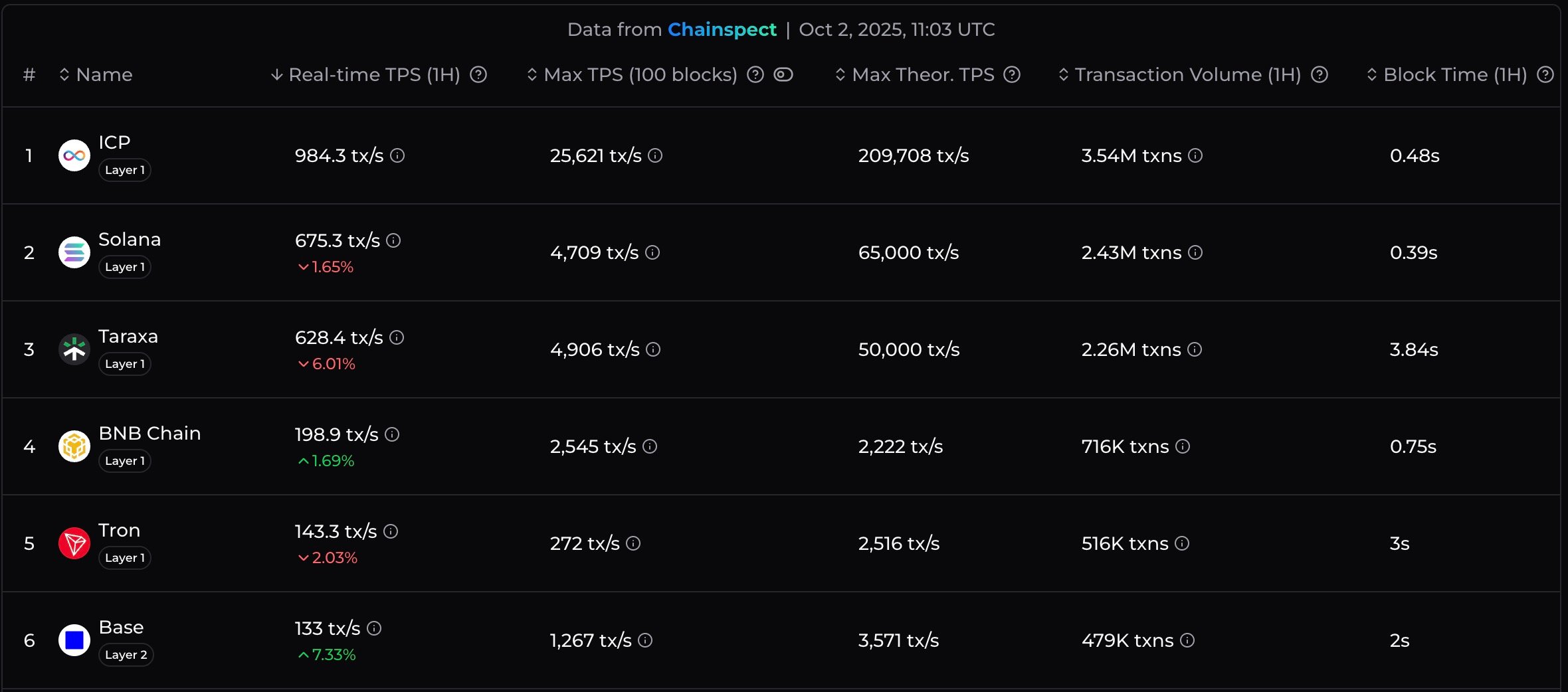

The comparison with modern blockchains is stark. Solana ($SOL) regularly clears 600+ TPS in real time and can hit a 65K TPS theoretical ceiling.

Source: Chainspect

Even Ethereum ($ETH), which historically struggled with scaling, now processes 20 TPS on mainnet and has multiple Layer 2s like Arbitrum ($ARB) and Base, clocking hundreds of TPS. By contrast, Bitcoin’s block time of nearly 10 minutes feels like dial-up internet in a world already running on 5G.

This mismatch is becoming harder to ignore as institutions pile in. ETFs have positioned $BTC as a vault asset – the digital equivalent of gold bars in storage. But retail adoption has different needs. People don’t just want to hold Bitcoin; they want to use it. Fast, cheap transfers. In-app microtransactions. Cross-chain gaming, tipping, and memes.

Without a scalability upgrade, Bitcoin risks being sidelined as a static ‘store of value’ while chains like Solana, BNB Chain, or even Tron host the actual cultural and financial activity. Bitcoin’s dominance still hovers above 50% of crypto’s market cap, but its lack of utility leaves a wide-open lane for challengers.

That’s the problem Bitcoin Hyper is built to fix.

The Solution: Bitcoin Hyper Layer 2

Bitcoin Hyper ($HYPER) positions itself as the first true Layer 2 for Bitcoin. Not a sidechain, not synthetic wrapped $BTC, but a system that preserves Bitcoin’s security while delivering real-world speed.

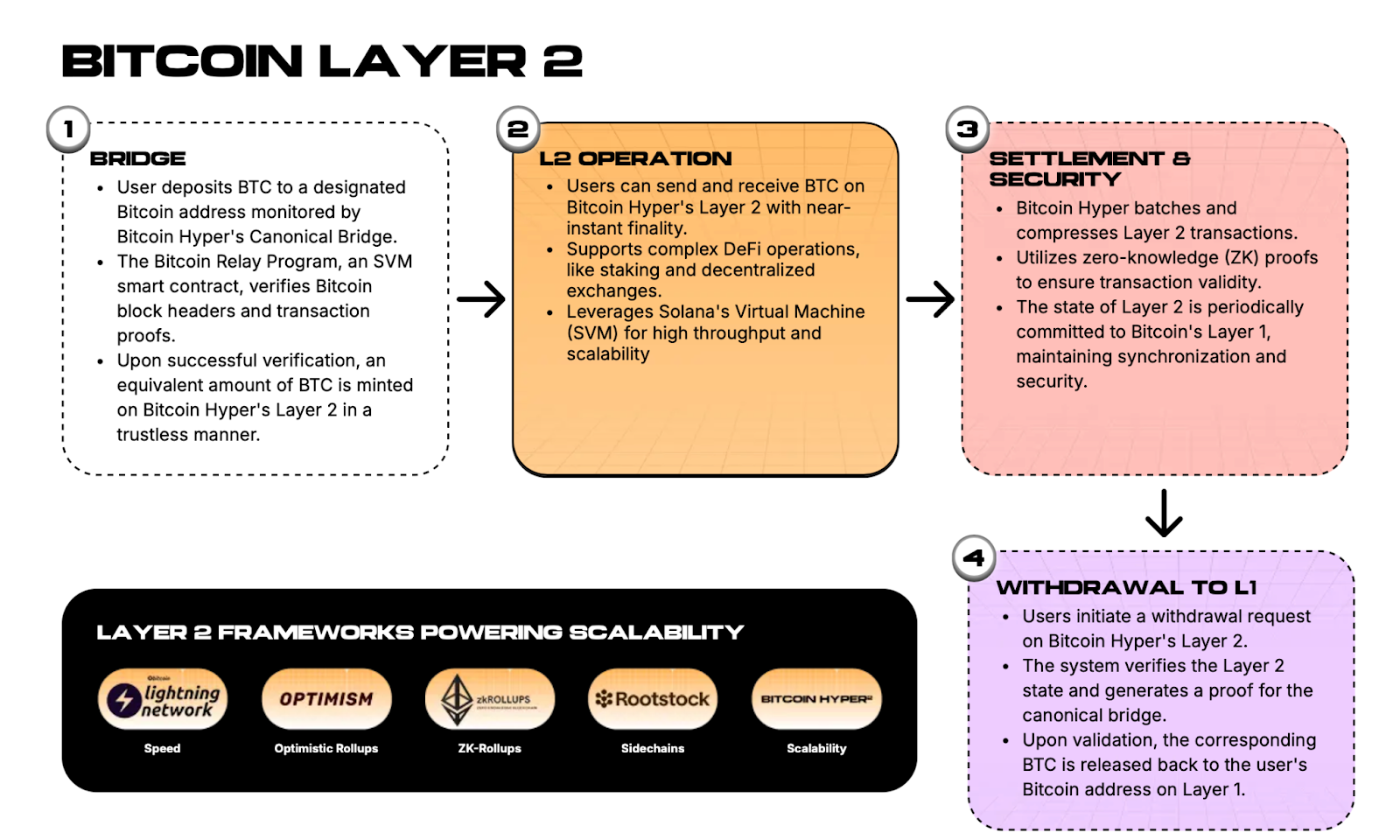

The process is simple enough to visualize. You deposit $BTC into the Bitcoin Hyper bridge. Once confirmed on-chain, the same amount of $BTC is minted 1:1 on the Hyper Layer 2.

From there, you can send, stake, or trade with sub-second finality and near-zero fees. When you’re ready to exit, you burn your $BTC on Layer 2, and the protocol unlocks your funds back on Bitcoin’s base chain – fully trustless.

Under the hood, Hyper runs on the Solana Virtual Machine (SVM). That means it inherits the same high throughput Solana is known for (hundreds of TPS live, with a 65K TPS ceiling) while staying interoperable with Solana’s ecosystem. Builders familiar with Solana tooling can deploy on Bitcoin Hyper immediately, effectively merging the two worlds.

From day one, Bitcoin Hyper is cross-chain, enabling assets and apps to move freely between BTC, ETH, SOL, and more. This unlocks the full spectrum of crypto culture, from payments and remittances to NFTs, DeFi protocols, meme coins, DAOs, and dApps – all backed by Bitcoin.

Think of Bitcoin as the vault, and Bitcoin Hyper as the execution layer. One stores the value, the other puts it to work. Learn more about the project in our what is Bitcoin Hyper guide.

The Financial Side: Presale & Whales

The numbers behind Bitcoin Hyper ($HYPER) show why it’s getting so much attention. The presale has already raised $19.8M, with tokens priced at just $0.013015. Our Bitcoin Hyper price prediction forecasts a high of $1.2 by 2023.

Additionally, early buyers can stake their holdings for a rate of around 60% APY, providing them with immediate passive returns before the project even launches.

Follow our step-by-step guide on how to buy Bitcoin Hyper.

Scarcity adds another layer of pressure. Each stage of the presale nudges the price higher, meaning the earlier you enter, the stronger your position once $HYPER lists.

Beyond speculation, the token has clear utility: it powers gas fees across the network, unlocks staking, grants governance rights, and offers priority access to Hyper’s launchpad.

The comparison to Ethereum’s ICO in 2015 is hard to ignore. Early $ETH buyers got in at $0.31 before the token eventually touched $4,800. No guarantees, but the narrative is familiar.

Visit the Bitcoin Hyper presale today.

Ayrıca Şunları da Beğenebilirsiniz

What We Know (and Don’t) About Modern Code Reviews

X claims the right to share your private AI chats with everyone under new rules – no opt out