How does the unsecured lending protocol 3Jane change the on-chain market?

Author:Alea Research

Compiled by: Felix, PANews

The DeFi money market was once seen as a revolutionary force that would disrupt traditional finance. Although on-chain lending remains active, its penetration among ordinary users and institutions is far from early expectations.

The biggest obstacle to the development of DeFi lending may not be user experience, smart contract risks or other factors, but the inability to provide low-value or unsecured loans. Whether it is the working class applying for mortgage loans or corporate mergers and acquisitions financing, it is important to be able to achieve excess borrowing.

Unsecured lending in the crypto space has long been seen as an “impossible triangle.” Without a way for decentralized protocols to access certain information and provide underwriting for users, it’s difficult for users to prove their credit score or ability to repay a loan.

3Jane combines the advantages of CeFi and DeFi and adopts a new approach to solve the problem of unsecured lending. This article aims to review the project white paper it released and discuss how unsecured lending changes the on-chain market.

Unsecured lending status

The traditional unsecured credit market is worth $12 trillion, but it is almost non-existent in the DeFi space—especially on the retail side. Although some protocols (such as Maple Finance and Goldfinch) use DeFi smart contracts to provide loans to institutions, this market is still small.

In terms of centralization in the crypto space, the lending market has still not recovered to its heyday in 2021. Major players such as Celsius and Genesis OTC provided unsecured lending to large players in the space. This trend stalled in 2022 and has not recovered yet. While this may be a good thing to ensure relative stability and sustainability in this cycle, a gap in the market still exists.

For mainstream assets and assets with larger market capitalizations, institutional lending is still necessary to maximize liquidity. However, if unsecured lending can be implemented, it could have a significant impact on the on-chain market. If solutions like 3Jane can work as expected and become more widely used, it could be a major breakthrough in the DeFi lending market.

3Jane 's Background

3Jane bypasses the barriers that prevent uncollateralized lending by using existing infrastructure for fiat-to-crypto deposits. Crypto user experience has improved significantly since the last cycle. One area of improvement is the ease of deposits. Plaid provides API services for users to connect their bank accounts to fintech and other applications, including Robinhood.

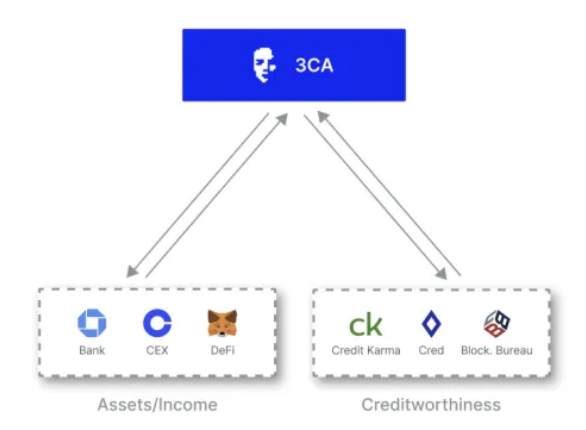

Plaid is 3Jane’s original way of connecting off-chain credit data with on-chain Ethereum addresses. In terms of user privacy, the Jane3 protocol uses zkTLS to securely transmit off-chain data.

Underwriting is not performed on-chain, instead, it is passed to an off-chain algorithm. The algorithm adjusts the terms of the loan based on the risk of the borrower before providing it. Factors that influence creditworthiness include the user's wallet balance and underlying DeFi activity, bank balance and assumed income, and relevant credit data associated with a bank account. Plaid itself does not extract credit histories, that is done by other providers.

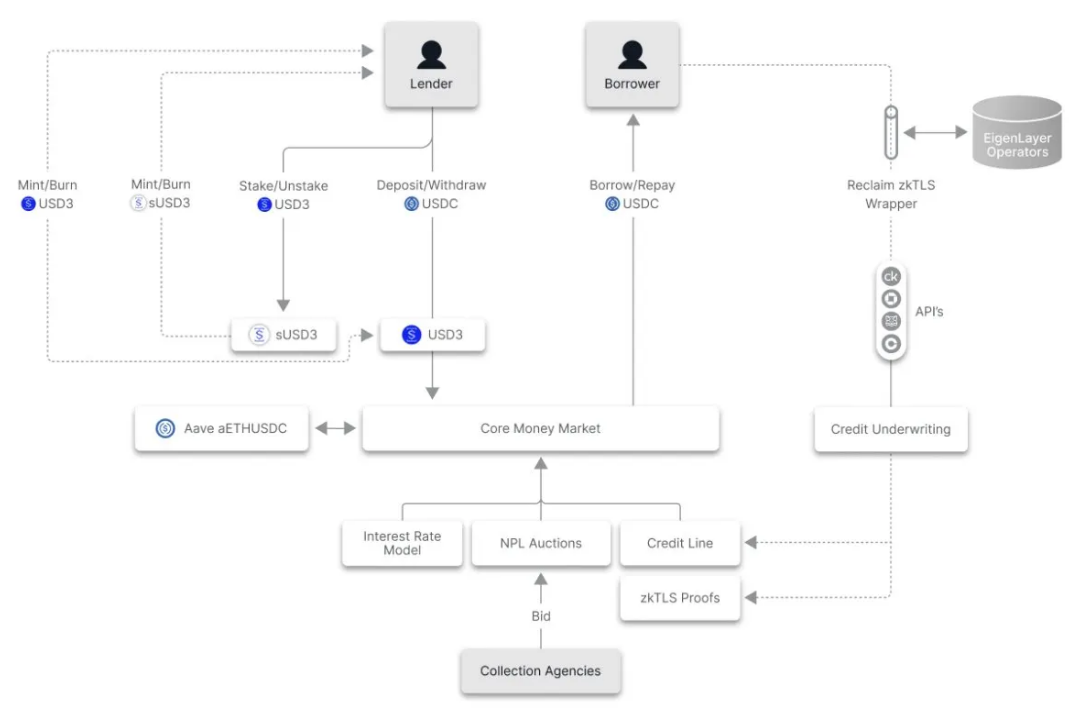

After considering all these factors, loans can be issued. The way it works is that lenders deposit their own USDC to mint 3Jane's native USD3 or sUSD3 and take on certain credit line risks. Since 3Jane's loans do not require any collateral support at all, whether an effective repayment guarantee mechanism can be established becomes the key - if it is not possible to ensure that borrowers perform on time, the platform will face the systemic risk of lenders withdrawing and liquidity drying up.

Outstanding debt on 3Jane is essentially treated as credit card debt or other types of unsecured debt; failure to pay can result in a significant cut to your credit score and the threat of collection. In 3Jane's scheme, the protocol auctions off the bad assets (debt) to U.S. collection agencies. These agencies will receive a portion of the collected debt, and the rest goes to the original lender.

Given the international nature of cryptocurrencies, it’s unclear how strong the deterrent to default will be, or whether lenders will feel comfortable with these measures. Still, it’s an interesting solution that illustrates how on-chain actions can have off-chain consequences, which is not common outside of bankruptcy or exploits.

3Jane’s self-proclaimed user base includes individual traders and miners, enterprises, and even AI agents. This means that the service is mainly suitable for heavy asset users. This may make lenders more comfortable and easier to collect debts if these users cannot repay.

Users can delete their personal data from the platform after repaying their loans, as keeping this data on the platform is important for debt collection in case the user fails to repay the loan. This data will be shared with specific debt collection agencies bidding on certain outstanding loans.

Overall, 3Jane represents a unique solution to the unsecured lending problem. Even if in practice the project’s model of primarily serving ultra-high net worth individuals (UHNWIs) and even institutions is not dissimilar to centralized unsecured lending seen in the past, 3Jane provides an interesting case study of what is possible with cryptocurrencies given advances in ZK-tech and Web2 integration.

Related reading: Decoding DeFi 2025: Ten key insights from consumer finance to technological innovation

Ayrıca Şunları da Beğenebilirsiniz

The History of Crypto Advertising Sponsorship: A Cycle Experiment with Buying Attention and Legitimacy

US-Israeli Joint Strike on Iran Sparks Market Turmoil and Bitcoin Slump