Solana price compresses into triangle apex, breakout risk builds

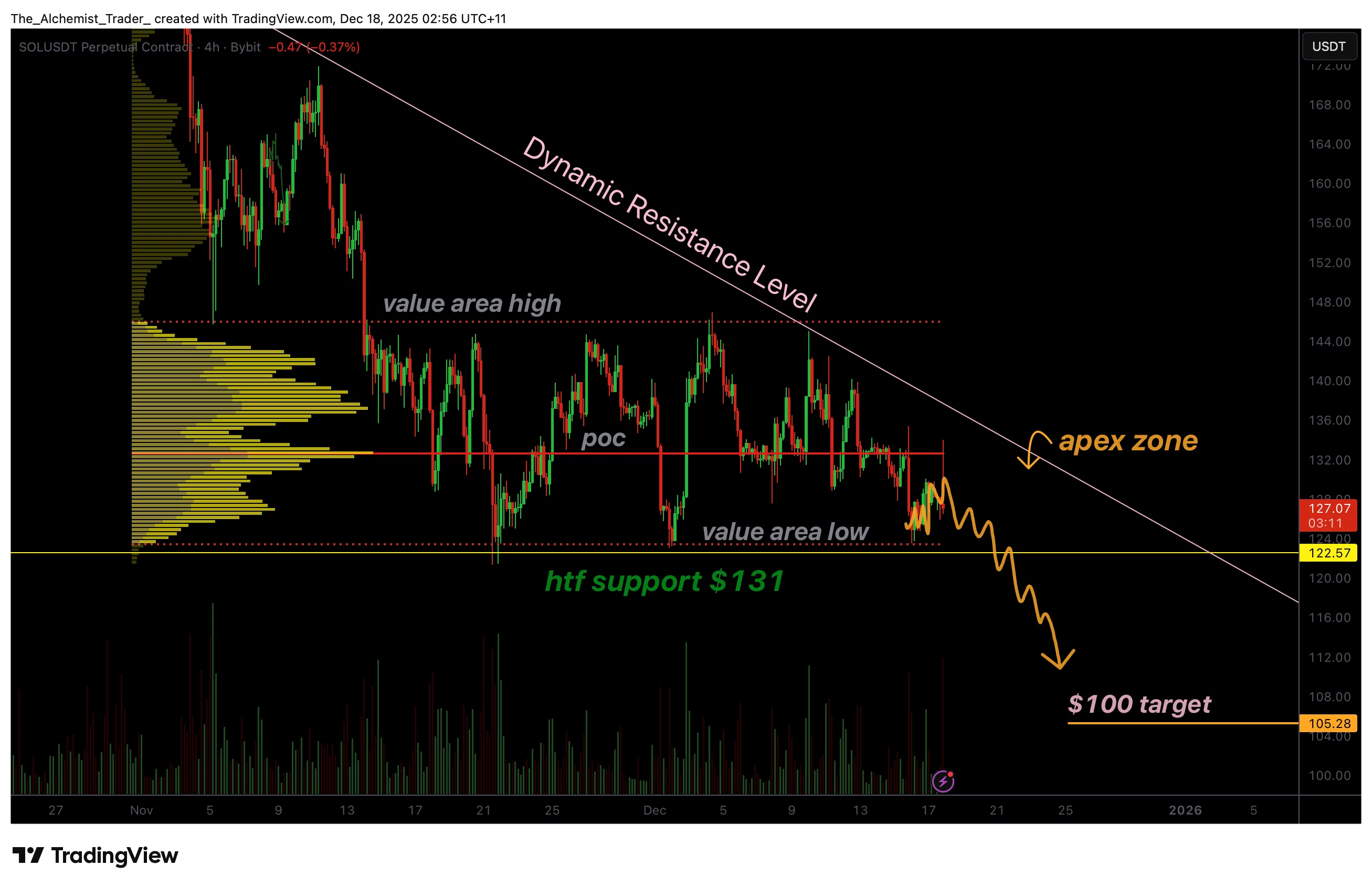

Solana price is compressed within a tightening apex near $122 support, with lower highs persisting, signaling a looming breakout with downside risk toward the $100 level.

- SOL repeatedly tests the $122 support level, weakening it.

- Lower highs confirm bearish market structure.

- A breakdown could trigger a move toward $100.

Solana (SOL) price is approaching a critical inflection point as price action compresses into a tightening apex structure. After spending an extended period consolidating around the $122 high-time-frame support, the market is now showing clear signs of compression rather than direction.

This type of setup often precedes a sharp expansion in volatility, and given the prevailing bearish market structure, the risk of a downside break is increasing.

Solana price key technical points

- SOL continues to test $122 as high-time-frame support, with the level weakening with each retest.

- A descending dynamic resistance is producing consistently lower highs.

- A break below support could trigger a liquidation cascade, targeting the $100 psychological level.

Solana’s recent price behavior reflects a classic compression pattern. Price has repeatedly tested the $122 support zone, holding it on multiple occasions. While repeated defenses may appear constructive at first glance, technical theory suggests the opposite: the more frequently a support level is tested, the weaker it becomes. Each test absorbs resting buy orders, reducing the level’s ability to hold during future pressure.

At the same time, Solana is respecting a clear descending trendline from above, marked by a series of lower highs. This dynamic resistance has consistently capped upside attempts, confirming that sellers remain in control. The interaction between weakening horizontal support and falling resistance has formed a tightening apex structure, signaling that a decisive move is approaching.

From a market-structure perspective, the bias currently favors downside continuation. The sequence of lower highs indicates that bullish momentum is failing to establish traction. In compression environments like this, breakouts tend to occur in the direction of the prevailing structure, which for Solana remains bearish, even as the Space token sale introduces leveraged prediction markets on Solana, highlighting a disconnect between ecosystem developments and near-term price structure.

A downside break from the apex would have significant implications. Below the $122–$121 region, liquidity is relatively thin, and there is a notable cluster of resting liquidity beneath the current price. If support gives way, Solana could experience a liquidation-driven move, where stops are triggered and downside momentum accelerates rapidly.

This type of move is often referred to as a liquidation cascade. It occurs when leveraged positions are forced to unwind quickly, amplifying price movement beyond what would be expected from spot selling alone. Given Solana’s history of sharp, momentum-driven moves, this risk cannot be ignored.

The next downside target in such a scenario sits near the $100 psychological level. This zone represents both a round-number support and a prior area of market interest, making it a logical destination for price if the apex resolves to the downside.

While reactions can occur before that level is reached, $100 remains the primary technical objective should the breakdown unfold.

For the bearish thesis to be invalidated, Solana would need to break above the dynamic resistance line and establish acceptance above recent lower highs. Without that shift, any short-term bounces are likely to be corrective rather than trend-changing.

What to expect in the coming price action

Solana is approaching the upper bound of its compression range, making a breakout increasingly likely in the near term.

A loss of the $121–$122 support zone could trigger a sharp downside expansion toward the $100 psychological level.

Until resistance is reclaimed, bearish resolution remains the higher-probability outcome.

Ayrıca Şunları da Beğenebilirsiniz

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch