Crypto ETF summer on the horizon as SEC approves Grayscale's Digital Large Cap and Rex-Osprey Solana ETFs

- The US SEC has approved the conversion of Grayscale's Digital Large Cap Fund into an ETF.

- The regulator has also allegedly approved Rex-Osprey SOL + Staking ETF, which could begin trading on Wednesday.

- The SEC is reportedly developing generic criteria for listing token-based ETFs to bypass the 19b-4 filing procedure.

The Securities & Exchange Commission (SEC) on Tuesday approved Grayscale's request to convert its Digital Large Cap Fund into an exchange-traded fund (ETF). The approval comes as Rex-Osprey prepares to launch its Solana (SOL) staking ETF, which aims to provide spot price exposure to SOL while also offering staking rewards.

Crypto ETFs see SEC greenlight amid boost in approval odds

The crypto market is shaping up for what looks to be a crypto ETF summer, as the SEC has begun greenlighting key filings.

The Commission approved Grayscale's proposal to convert its Digital Large Cap Fund into an ETF on an accelerated basis, according to a filing on Tuesday. The fund currently holds a mix of cryptocurrencies, including Bitcoin (BTC), Ether (ETH), Solana, XRP, and Cardano (ADA). As a result, investors are optimistic that the agency will approve altcoin ETF filings since it allowed the fund that contains some of these altcoins to launch.

Grayscale's Digital Large Cap Fund allocates 79.9% of its holdings to Bitcoin, 11% to Ethereum, and nearly 5% to XRP. Solana and Cardano currently hold 3% and 0.74%, respectively. Since its launch in 2018, the fund has netted nearly $755 million in assets under management (AuM).

Rex-Osprey is also set to launch the Rex-Osprey SOL + Staking ETF (SSK), which is the first staked crypto ETF in the US. The launch follows a statement from the SEC on Friday, revealing that the agency had no further comments on the firm's ETF filing.

The statement served as a potential green light from the regulator, allowing Rex-Osprey to launch its Solana staking product. The fund will offer investors direct exposure to Solana's spot price alongside on-chain staking rewards that may be baked into the net asset value (NAV) of the product as opposed to directly rewarding investors with the yield. However, the launch appears nuanced, with some investors uncomfortable that the product didn't get outright traditional approval from the SEC, noted Bloomberg ETF analyst Eric Balchunas in an X post on Tuesday.

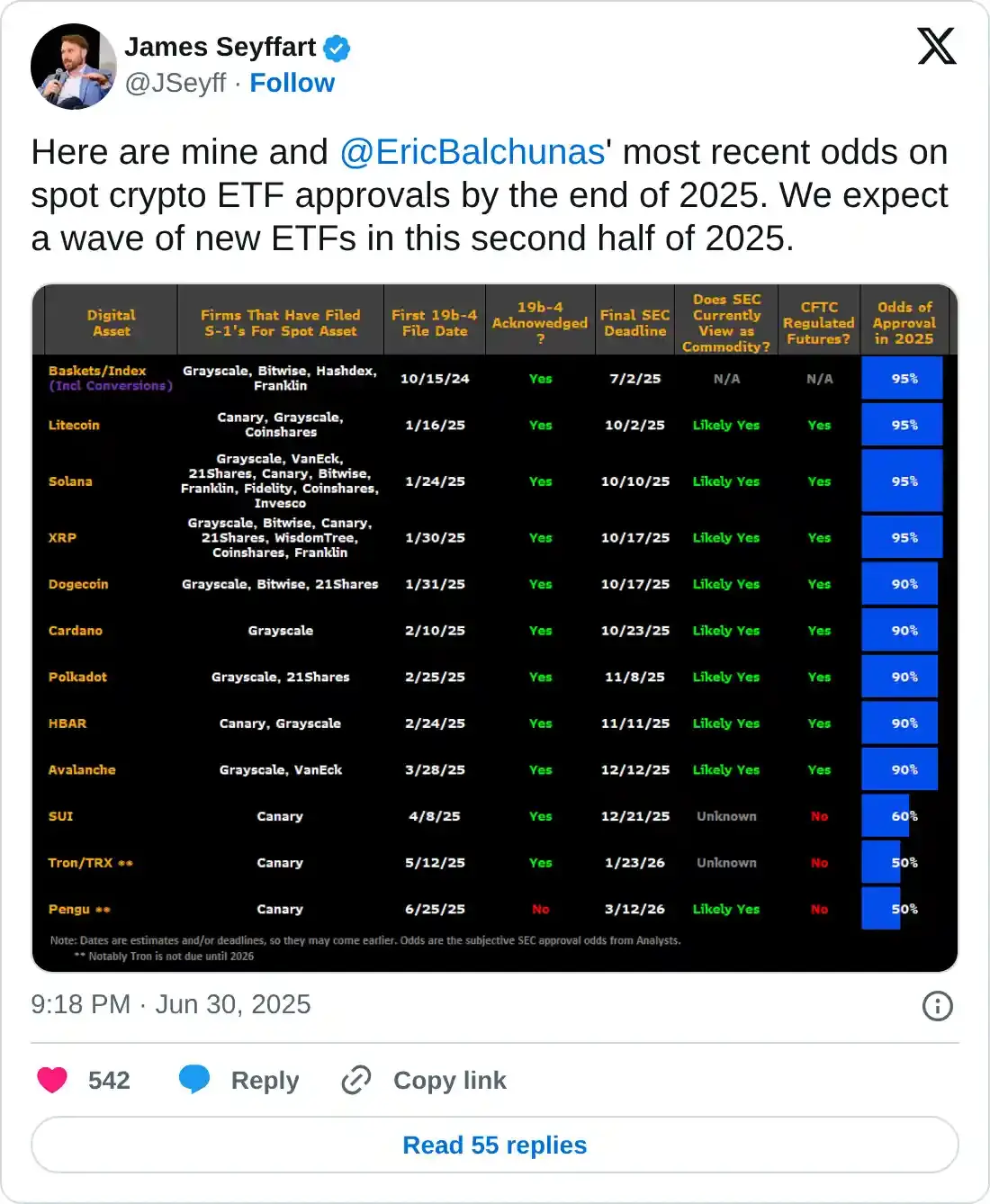

The approvals come as expectations of altcoin ETF approvals have heightened in the past month. Bloomberg analysts James Seyffart and Eric Balchunas released an update to their crypto ETF approval odds for the second time in less than two weeks.

The analysts added 50% approval odds for TRX and PENGU ETF filings, with no changes made to the other altcoins. There are currently several 19b-4 ETF filings based mainly on ten altcoins, including XRP, Solana, Litecoin, SUI, and Avalanche.

Bloomberg analysts have awarded a 95% chance of approval for some of these altcoin ETFs as they anticipate a rush of approvals in H2.

Meanwhile, the SEC is allegedly planning to develop listing criteria for token-based ETFs that will allow issuers to bypass a 19b-4 filing, Eleanor Terret stated in an X post on Tuesday.

"The thinking, I'm told, is that if a token meets the criteria, issuers could skip the 19b-4 process, file an S-1, wait 75 days, and the exchange could list it," Terret wrote in a Tuesday X post.

The listing standard is still unclear but could involve the tokens' market cap, trading volume, and liquidity. The process is reportedly being carried out by the agency with the help of exchanges.

This follows the SEC's Division of Corporation Finance's release of new guidance on disclosure expectations for issuers applying to launch crypto ETFs.

Ayrıca Şunları da Beğenebilirsiniz

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council