Why did Tether invest over $770 million in the video platform Rumble? Business experience backed by Trump’s circle

Author: Nancy, PANews

On February 7, video sharing platform Rumble announced that it had completed a $775 million strategic investment from Tether. Although Tether, which has an annual profit of tens of billions of dollars, has been accelerating its investment pace in the past few months, Rumble's cross-field investment is still surprising.

The opportunity behind the strategic investment of over US$770 million

Since Rumble announced in December 2024 that it had reached a final agreement with Tether to obtain a strategic investment of US$775 million, the investment and tender offer were officially completed recently. As part of the transaction, Tether purchased 103,333,333 shares of Rumble Class A common stock at a price of US$7.50 per share for a total amount of US$775 million. Of this, US$250 million will be used for growth plans, including attracting more content creators, strategic acquisitions, and enhancements to Rumble Cloud's technical infrastructure.

As a video sharing platform founded in 2013, Rumble has won the favor of a large number of creators for advocating freedom of speech, fairer profit distribution and granting more copyrights. It has also become a safe haven against excessive regulation of traditional social media platforms. For example, during the 2024 US presidential election, Rumble broke the record with 1.79 million concurrent online viewers and became the center of political discussion.

Regarding this investment, Rumble CEO Chris Pavlovski once revealed in an interview with Barstool Sports founder Dave Portnoy that this investment will promote Rumble's global expansion, attract new creators, and redefine the meaning of a free speech platform. In addition, Pavlovski also mentioned the impact of Trump's election on Rumble's mission, and believed that cooperation with Tether will help Rumble expand globally, especially in areas where freedom of speech is suppressed. Integrating cryptocurrencies will change the way creators monetize their content, provide crypto-based rewards and payment options, and further reduce dependence on centralized systems.

In addition, Tether’s decision to invest in Rumble may be related to the latter’s close ties with Trump and its desire to expand its business in the United States.

Rumble has a close relationship with US President Trump, and is even called a "Trump concept stock" by the outside world. As early as during the 2020 US presidential election, Trump was banned from mainstream social media such as Facebook, Twitter and YouTube, and began to switch to Rumble after losing his social media voice. At the same time, Trump also launched his own social platform Truth Social at the time, which used the video and streaming services provided by Rumble. It is worth mentioning that in addition to Trump, Narya Capital Management, the venture capital fund of US Vice President JD Vance, also participated in Rumble's investment.

With Trump in office again, the friendly crypto policy environment in the United States has also attracted Tether to make a layout. In January this year, Tether CEO Paolo Ardoino pointed out in an interview with Bloomberg TV that the expected improvement in the regulatory environment of the crypto industry, coupled with Tether's recent $775 million investment in Rumble, a US listed company, provided the company with an opportunity to re-evaluate the US market. However, he also emphasized that although the possibility of further entering the US market is not ruled out, it is necessary to wait for regulatory clarity and specific guidance, and the final decision will be made based on the development of the US legal framework.

Buy Bitcoin, crypto strategy helps stock prices rise sharply

Since the end of last year, Rumble has frequently appeared in the crypto field. In addition to receiving Tether's investment, Rumble has also actively built up its Bitcoin reserves and launched a series of related crypto products.

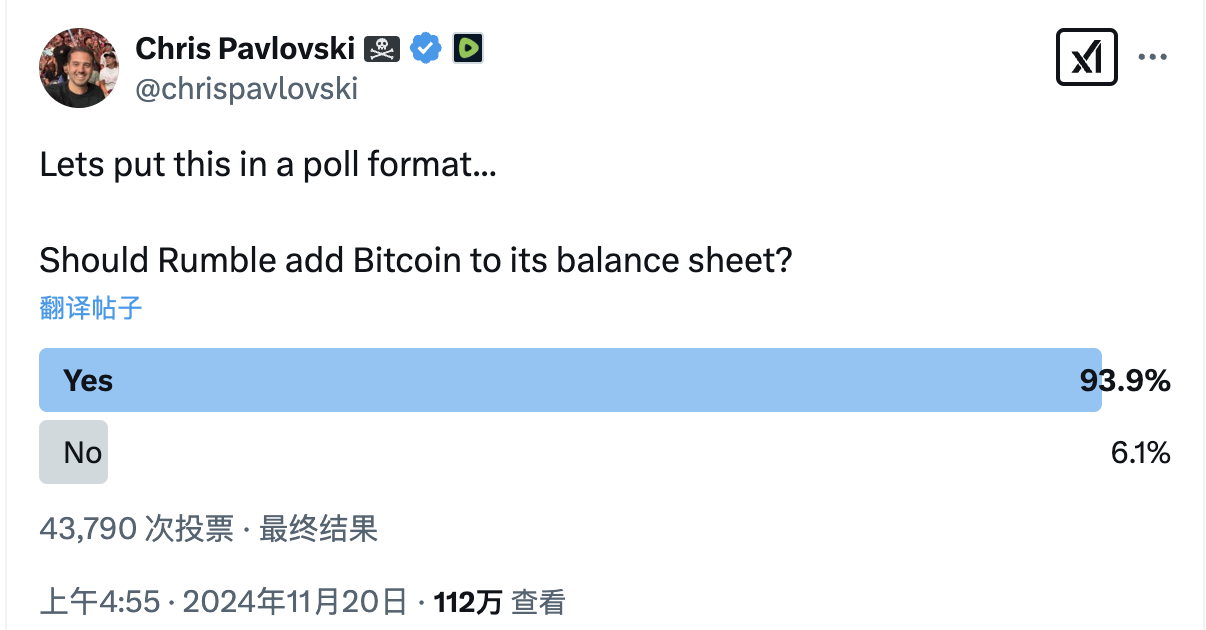

"Should Rumble add Bitcoin to its balance sheet?" In November 2024, Rumble CEO Chris Pavlovski initiated a vote on X, asking whether Bitcoin should be included in the company's balance sheet, which received a high vote of support.

A few days later, Rumble announced an investment of up to $20 million to purchase Bitcoin as an important part of the company's financial diversification strategy, positioning Bitcoin as a strategic asset and inflation hedging tool.

At that time, Chris Pavlovski said that Bitcoin is still in the early stages of adoption, and crypto-friendly US government policies and the increase in institutional investors are accelerating this process. Unlike any government-issued currency, Bitcoin will not be diluted by endless money printing, which makes it a valuable inflation hedge and an excellent addition to the treasury. The company plans to integrate cryptocurrencies into its ecosystem to create a leading video and cloud service platform for the crypto community. Of course, Chris Pavlovski also said later that this would not be the last time, suggesting that the company may continue to increase its holdings of Bitcoin assets in the future.

In January this year, Rumble also announced that it will launch Rumble Wallet, a crypto wallet that supports Bitcoin and USDT, which will provide creators with a new way to trade. Creators can receive fan rewards and subscription income through these two cryptocurrencies. Tether CEO Paolo Ardoino said, "A cool feature of Rumble Wallet is the use of AI agents/assistants to help manage payments, recommend Bitcoin savings strategies based on past activities, and reward the most popular creators."

The layout of this series of encryption strategies has also had a positive impact on Rumble's stock price. According to Google Finance data, since Rumble announced its intention to adopt a Bitcoin funding strategy, the company's stock price has soared, with its stock price rising as high as 169.8%, setting a record high of $16.27.

Ayrıca Şunları da Beğenebilirsiniz

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include: