Ethereum Price Forecast: BitMine holdings cross 560K ETH as ETHA hit $10 billion inflows on 1st anniversary

Ethereum price today: $3,680

- BitMine ETH holdings cross the $2 billion mark after purchasing an additional 266,000 ETH last week.

- BlackRock's Ethereum ETF hit the $10 billion mark, becoming the third fastest in history to achieve this milestone.

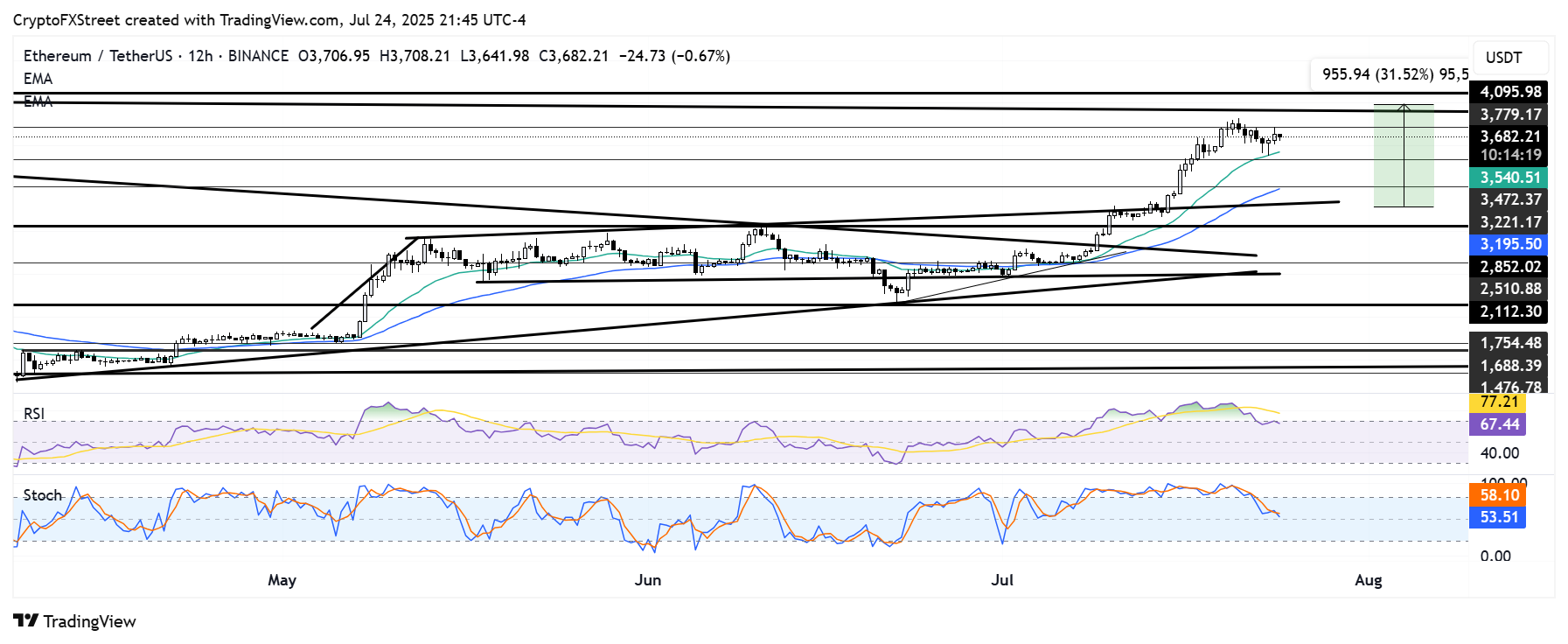

- ETH retested the key resistance at $3,780 after bouncing off the 20-period EMA on the 12-hour chart.

Ethereum (ETH) moved toward the $3,780 resistance on Thursday after crypto treasury company BitMine (BMNR) announced that it had grown its holdings to more than 560,000 ETH over the past week. Meanwhile, BlackRock iShares Ethereum Trust (ETHA) hit the $10 billion mark, becoming the third fastest ETF in history to reach the milestone.

BitMine scales treasury above 560K ETH, ETHA inflows hit $10 billion

BitMine Immersion Technologies said that its Ethereum holdings exceeded $2 billion on Thursday. The company's stash has grown by over 700% above the $250 million private placement it used to kick-start its treasury.

BitMine now holds 566,776 ETH, making it the largest corporate holder of ETH. The company's large purchase pushed it above SharpLink Gaming, which holds 360,807 ETH. BitMine has purchased approximately 266,109 ETH for over $1 billion since last week. The move adds to the company's vision of purchasing up to 5% of the total ETH supply.

"We are well on our way to achieving our goal of acquiring and staking 5% of the overall ETH supply," said Thomas "Tom" Lee, Fundstrat CIO and Chairman of BitMine's board of directors.

The development follows the one-year trading anniversary of US spot Ethereum exchange-traded funds (ETFs), which have marked a cumulative net inflow of $8.88 billion, according to SoSoValue data.

Likewise, BlackRock's Ethereum ETF, ETHA, set a new milestone as the third-fastest ETF to hit the $10 billion mark, behind the firm's IBIT and Fidelity's FBTC products, according to Bloomberg analyst Eric Balchunas.

ETHA achieved the milestone in 251 days, compared to 34 days for IBIT and 53 days for FBTC. Notably, the product added $5 billion in assets under management (AUM) in just ten days, signaling strong growth in Ethereum products despite their poor start last year.

Ethereum Price Forecast: ETH retests key resistance at $3,780

Ethereum saw $136.15 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $75.88 million and $60.27 million, respectively.

ETH bounced off the 20-period Exponential Moving Average (EMA) near the support at $3,470. The top altcoin is now retesting the resistance at $3,780 after faltering before it on Monday. A firm move above this resistance could see ETH test the key level at $4,100. On the downside, ETH could find support at $3,220 if it loses the $3,470 level.

ETH/USDT 12-hour chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels but trending downward after declining from their overbought regions on Monday.

Ayrıca Şunları da Beğenebilirsiniz

Stijgt de Solana koers naar $150 door institutioneel treasury gebruik?

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon