Fed Cuts And Signals More, But Cryptos Barely Move the Dial

The Federal Reserve’s recent decision to lower its policy rate by 25 basis points was widely expected, yet the market’s reaction was anything but ordinary. At first glance, the the United States seems to be making good financial decisions: Chair Powell's opening statement indicated June quarter growth was over 3%, unemployment is at a record low of 4.3%, and the stock market has hit all-time highs. This seemingly robust data makes a rate cut puzzling.

However, as Fed Chair Jerome Powell described it, this was a "risk management cut," signaling that policymakers are looking beyond the headline numbers to address brewing vulnerabilities.

The Fed’s move was a proactive measure to stimulate the economy, with policymakers suggesting that three additional cuts are likely needed to prevent a slowdown and ensure a resurgence in the jobs market. This stance, however, has been met with skepticism by financial markets, as evidenced by a muted reaction in stocks and a curious shift in the bond market.

BRN Head of Research Timothy Misir is betting that four more 25 bps cuts are needed for the situation to stabilize. adding that "lack of trade policy clarity and its impact and, a weaker currency are the immediate risks even before the benefits of lower borrowing rates kick in."

Markets' Immediate Reaction Remains Muted

The bond market's reaction was particularly telling. Following the announcement, rates paradoxically ended up higher, and the yield curve steepened.

This is a significant indicator. A steepening curve means the difference between short-term and long-term bond yields is increasing, often suggesting that investors anticipate higher inflation or stronger economic growth in the future, which runs counter to the Fed’s stated goal of stimulating a weakening economy.

It implies that the market may not trust the Fed's narrative of a "risk management cut" and instead sees it as a move that could lead to inflationary pressures down the line. The 10-year Treasury yield, for instance, initially dipped below 4% before climbing dramatically, reinforcing this sentiment.

Other asset classes also reflected a pre-priced-in reaction even though more cuts were announced for this year than in June. The dollar edged higher as the Fed signaled the rate path to be data dependent and the policy decisions would be meeting-to-meeting.

Wall Street stocks closed lower, with all those assets boosted by bets for Thursday's Fed cut showing little signs of life after the central bank action.

Gold, which had soared by over 40% this year, surpassing the performance of other assets such as the S&P 500 index, briefly slipped after the announcement, indicating that the anticipated "Fed boost" was already fully reflected in its price.

Gold's surge this year has been driven more by sustained geopolitical concerns and central bank purchases than by the latest monetary policy.

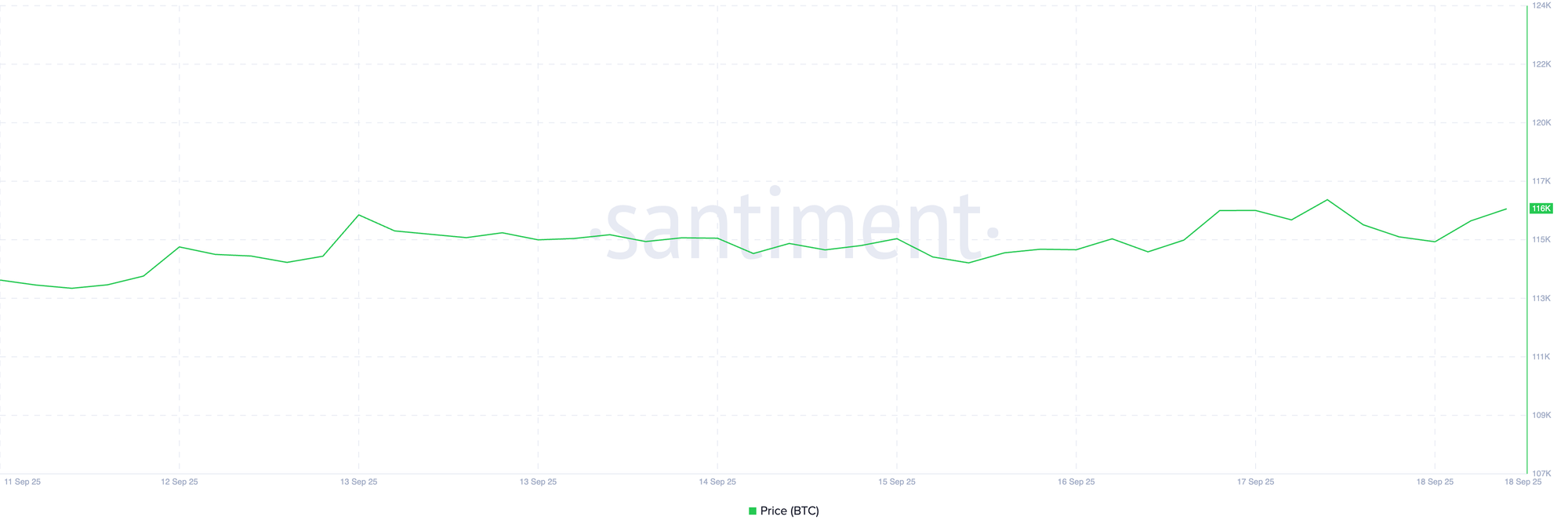

Bitcoin was last trading around $116,902 after having gained about 2.6 percent over the past week.

Source: Santiment

Source: Santiment

Market Intricacies and Political Nuances

The disconnect between the strong headline jobs data and the Fed's concerns about labor market weakness is a crucial point. While unemployment remains low, other indicators, such as a shift in job composition or slowing wage growth in specific sectors, may be giving the Fed cause for concern.

The Fed's decision to cut rates despite rising inflation, partly attributed to the impact of trade tariffs, is also an unusual move that has added to the market's confusion.

The sole dissenting vote from newly-sworn-in Fed member Stephen Miran, a Trump ally, is an interesting political footnote. While a single dissent is not uncommon, it raises questions about the political independence of the Fed, especially in a politically charged environment.

The remaining members' unanimous vote for the rate cut can be interpreted as a show of solidarity behind Chair Powell, a message that the Fed remains a unified and independent body.

However, the market's skeptical reaction suggests that this uplifting message has yet to fully resonate. But that is a nuance best left for time to deliver the message.

Elsewhere

Blockcast

Bridging TradFi & Crypto: Reap's Daren Guo on Stablecoin Innovation

In this episode of Blockcast, Takatoshi Shibayama interviews Daren Guo, co-founder of Reap, a company pioneering stablecoin infrastructure for modern finance. Daren shares his journey from a traditional finance background, having been part of Stripe's growth team, to becoming a key player in the crypto space. He also discusses the transformative role of stablecoins in global payments, particularly their impact on cross-border transactions and financial inclusion in emerging markets.

Like what you hear? Subscribe to Blockcast on Spotify, Apple Podcasts, or wherever you listen.

Click on the image to enjoy 30% off tickets with promo code: BLKHD

Click on the image to enjoy 30% off tickets with promo code: BLKHD

Ayrıca Şunları da Beğenebilirsiniz

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Trump rethinks China tech curbs amid Nvidia H200 review