FTX Recovery Trust to Release $1.6B in September Payout — Creditors Edge Closer to $16.5B Total

This marks the third round of repayments since the trust started cutting checks earlier this year, bringing some measure of relief to those who lost funds in one of crypto’s most infamous implosions.

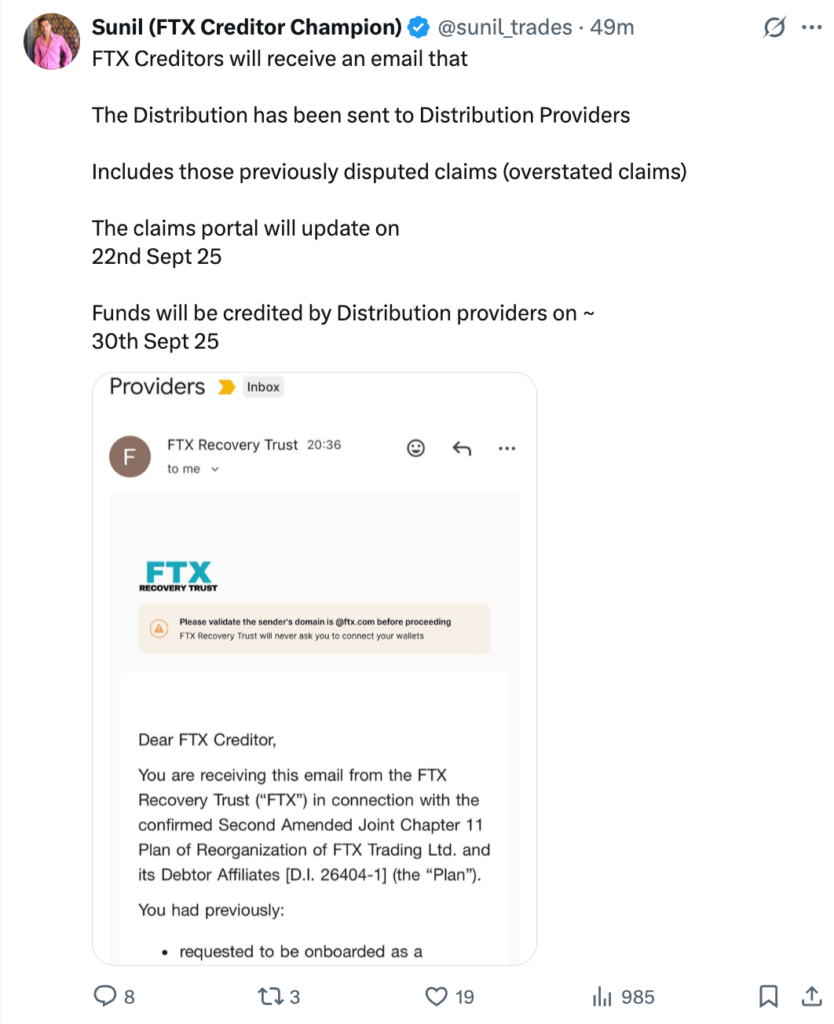

The claims portal will open tomorrow, source: X

Who Gets What This Time

September’s payout isn’t uniform—it’s a carefully sliced pie:

- Dotcom Customer Claims: 6% distribution

- US Customer Entitlement Claims: 40% distribution

- General Unsecured Claims & Digital Asset Loan Claims: 24% distribution

- Convenience Claims: a whopping 120% reimbursement

That last one—“convenience claims”—is essentially the bankruptcy court’s way of settling smaller claims quickly and cleanly. Creditors in that category are actually walking away whole, plus a little extra, which is unusual in bankruptcy cases.

The Bigger Picture

This latest tranche follows a $1.2 billion disbursement in February and a $5 billion payout in May, with up to $16.5 billion ultimately earmarked for creditors. Given how chaotic the collapse was in 2022, when FTX’s implosion dragged the entire crypto market deeper into winter, the fact that creditors are seeing money back at all—and at this scale—is remarkable.

But make no mistake: these repayments are not a victory lap. They are the unwinding of one of the most spectacular failures in financial history. Traders still watch each new distribution nervously, wondering whether sudden liquidity for former customers might slosh back into crypto markets in unpredictable ways.

The Shadow of SBF

All of this, of course, is happening under the long shadow of Sam Bankman-Fried. Convicted in late 2023 on seven counts ranging from wire fraud to money laundering conspiracy, SBF was sentenced in March 2024 to 25 years in prison. Judge Lewis Kaplan called his crimes “serious” enough to warrant decades behind bars.

Naturally, SBF isn’t done yet. His lawyers are appealing the conviction this November, arguing that the trial was unfair and—almost laughably—that FTX was never actually insolvent and always had the funds to pay customers. Tell that to the creditors waiting nearly two years for partial repayments.

Why It Matters

For many, these repayments are less about the money and more about closure. The FTX collapse wasn’t just another exchange failure; it was a confidence nuke that reshaped how regulators, investors, and even normies view crypto.

Now, as the Recovery Trust continues to unwind what’s left of the empire, the question isn’t just how much creditors will get back—but whether the industry can rebuild the trust that Sam Bankman-Fried so thoroughly torched.

Ayrıca Şunları da Beğenebilirsiniz

BitGo expands its presence in Europe

Wormhole Unveils W Token 2.0 with Enhanced Tokenomics