Bitcoin Is The Standard Now: Outperform It, Or Get Left Behind – CEO

Bitcoin’s climb shows no signs of stopping, and one of crypto’s loudest bulls says the rally could keep running as long as governments keep expanding the money supply.

According to his CNBC interview, Anthony Pompliano called Bitcoin a “savings technology” and argued that people can protect their earnings by putting part of their money into BTC.

Reports have disclosed that Bitcoin recently hit an all-time high of $126,100 and traded around $122,500 at press time, figures that form the backdrop for Pompliano’s comments.

Pompliano Frames Bitcoin As Savings Technology

Pompliano told CNBC that the core idea is simple: work, save, and put part of your savings into crypto to preserve value as fiat currencies weaken.

He said that as long as governments and central banks keep printing money, demand for a scarce asset like Bitcoin should remain strong.

Based on his on-camera remarks, he expects the trend to push adoption higher and to reshape how investors think about storing wealth.

The New ‘Hurdle Rate’

Pompliano went further, describing the top digital asset as the “hurdle rate” of modern finance — a baseline investors must beat before choosing other assets.

He contrasted Bitcoin’s performance with traditional markets, arguing that the S&P 500 has risen by more than a hundred percent since 2020 in fiat terms but has fallen roughly 90% when priced in BTC, a comparison he used to stress BTC’s long-term outperformance. This framing explains why he and some others say, “If you can’t beat Bitcoin, buy it.”

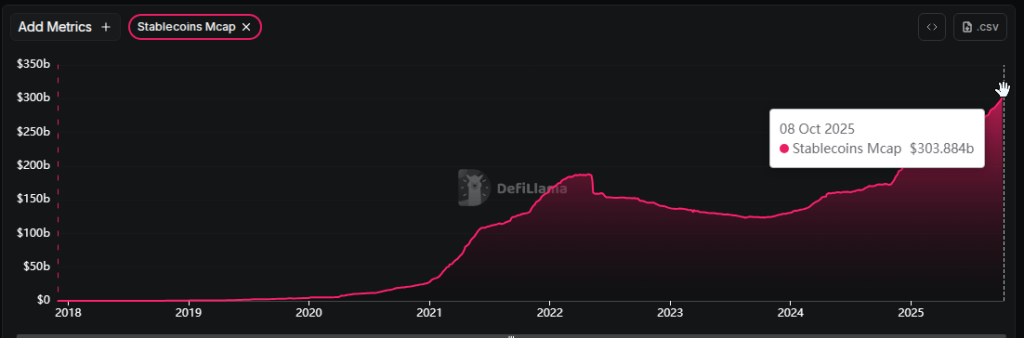

Further Gains AheadBased on projections, BTC could climb about 20% to $148,500 by the end of the year. The same forecasts sees a jump in market infrastructure: the number of crypto exchange-traded funds could double to 80, and stablecoin circulation is predicted to reach $500 billion as more money moves onchain.

Those observations realistically bolster an argument that the market is maturing beyond the realm of a short-term speculation.

Market intelligence reveals that the total cryptocurrency market is sizeable at roughly $4.3 trillion, according to CoinGecko.

In addition, another market data source, DeFiLlama, reports that the stablecoin supply has exceeded $300 billion as an indication that there is a lot of liquidity onchain and it could flow into risk assets like Bitcoin.

Featured image from Kitco, chart from TradingView

Ayrıca Şunları da Beğenebilirsiniz

Bitcoin (BTC) Supply Held by Large Companies Revealed – Here Are the Latest Figures

Here’s Why Pi Network is Not Processing Your Payment Requests