PANews reported on December 31 that the Financial Accounting Standards Board (FASB) plans to study in 2026 whether certain crypto assets can be classified as cashPANews reported on December 31 that the Financial Accounting Standards Board (FASB) plans to study in 2026 whether certain crypto assets can be classified as cash

The U.S. Financial Accounting Standards Board plans to study in 2026 whether crypto assets such as stablecoins can be classified as cash equivalents.

PANews reported on December 31 that the Financial Accounting Standards Board (FASB) plans to study in 2026 whether certain crypto assets can be classified as cash equivalents and how to handle the accounting issues related to crypto asset transfers. This decision comes against the backdrop of the Trump administration's push for crypto investment.

Piyasa Fırsatı

Union Fiyatı(U)

$0.002977

$0.002977$0.002977

USD

Union (U) Canlı Fiyat Grafiği

Sorumluluk Reddi: Bu sitede yeniden yayınlanan makaleler, halka açık platformlardan alınmıştır ve yalnızca bilgilendirme amaçlıdır. MEXC'nin görüşlerini yansıtmayabilir. Tüm hakları telif sahiplerine aittir. Herhangi bir içeriğin üçüncü taraf haklarını ihlal ettiğini düşünüyorsanız, kaldırılması için lütfen [email protected] ile iletişime geçin. MEXC, içeriğin doğruluğu, eksiksizliği veya güncelliği konusunda hiçbir garanti vermez ve sağlanan bilgilere dayalı olarak alınan herhangi bir eylemden sorumlu değildir. İçerik, finansal, yasal veya diğer profesyonel tavsiye niteliğinde değildir ve MEXC tarafından bir tavsiye veya onay olarak değerlendirilmemelidir.

Ayrıca Şunları da Beğenebilirsiniz

Coinbase CEO Ends Speculation on NBA Star Kevin Durant’s Blocked Bitcoin Account

The post Coinbase CEO Ends Speculation on NBA Star Kevin Durant’s Blocked Bitcoin Account appeared on BitcoinEthereumNews.com. This week, Coinbase CEO Brian Armstrong confirmed that Kevin Durant had regained access to a Coinbase account that he had opened almost 10 years ago. This puts an end to the speculation surrounding the NBA star’s supposed permanent lockout. Durant first entered the market in late 2016, when Bitcoin was trading at around $650. The largest cryptocurrency now changes hands at around $117,000, representing an increase of around 180 times since his initial purchases. Over the past five years alone, Bitcoin’s price has increased by more than 950%, turning initial investments into multimillion-dollar holdings. The account issue arose during a discussion at CNBC’s Game Plan conference in Los Angeles. Durant’s business partner Rich Kleiman said his client had been unable to log in for years. Hours later, Armstrong addressed the matter directly on social media, writing that the recovery process had been completed. NBA star becomes major U.S. exchange investor Durant’s connection to Coinbase goes beyond a user account. In 2017, he and Kleiman added Coinbase to the portfolio of their 35V investment firm. Four years later, the two companies signed a marketing agreement, making Durant one of the company’s public ambassadors. Despite these ties, he was unable to access Bitcoin purchased prior to the partnership and investment. The scale of the numbers involved puts the recovery in perspective. A $10,000 Bitcoin investment at Durant’s entry price would now be worth almost $1.8 million. Even a single coin purchased in 2016 would now be worth more than $116,000. Durant, who is set to play in the upcoming NBA season with the Houston Rockets, has now regained direct control of assets acquired almost 10 years ago. Source: https://u.today/coinbase-ceo-ends-speculation-on-nba-star-kevin-durants-blocked-bitcoin-account

Paylaş

BitcoinEthereumNews2025/09/20 06:02

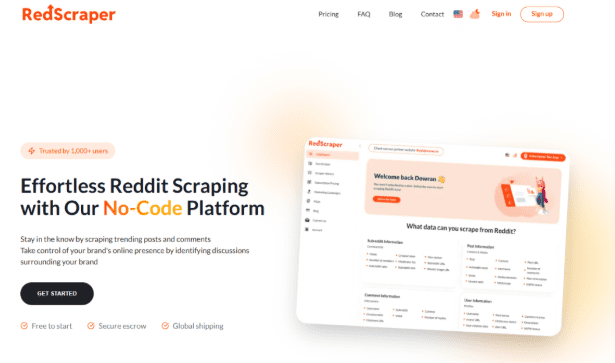

Unlock Actionable Reddit Insights with a Smart Reddit Scraper

Reddit has evolved into one of the most influential platforms on the internet. With millions of active users, thousands of niche communities, and real, unfiltered

Paylaş

Techbullion2026/01/01 18:18

Tether Buys 8,888 BTC, Joins Top 5 Largest Bitcoin Wallets

Introduction In a significant move at the close of 2025, Tether has increased its Bitcoin holdings substantially, reflecting its strategic confidence in digital

Paylaş

Crypto Breaking News2026/01/01 18:41