A new standard for global money flows? A detailed look at Circle’s cross-border payment network CPN

Compiled by: Felix, PANews

Circle, the issuer of the USDC stablecoin, said on April 21 that it expects to launch the Circle Payments Network (CPN), a cross-border payment network powered by stablecoins, in May.

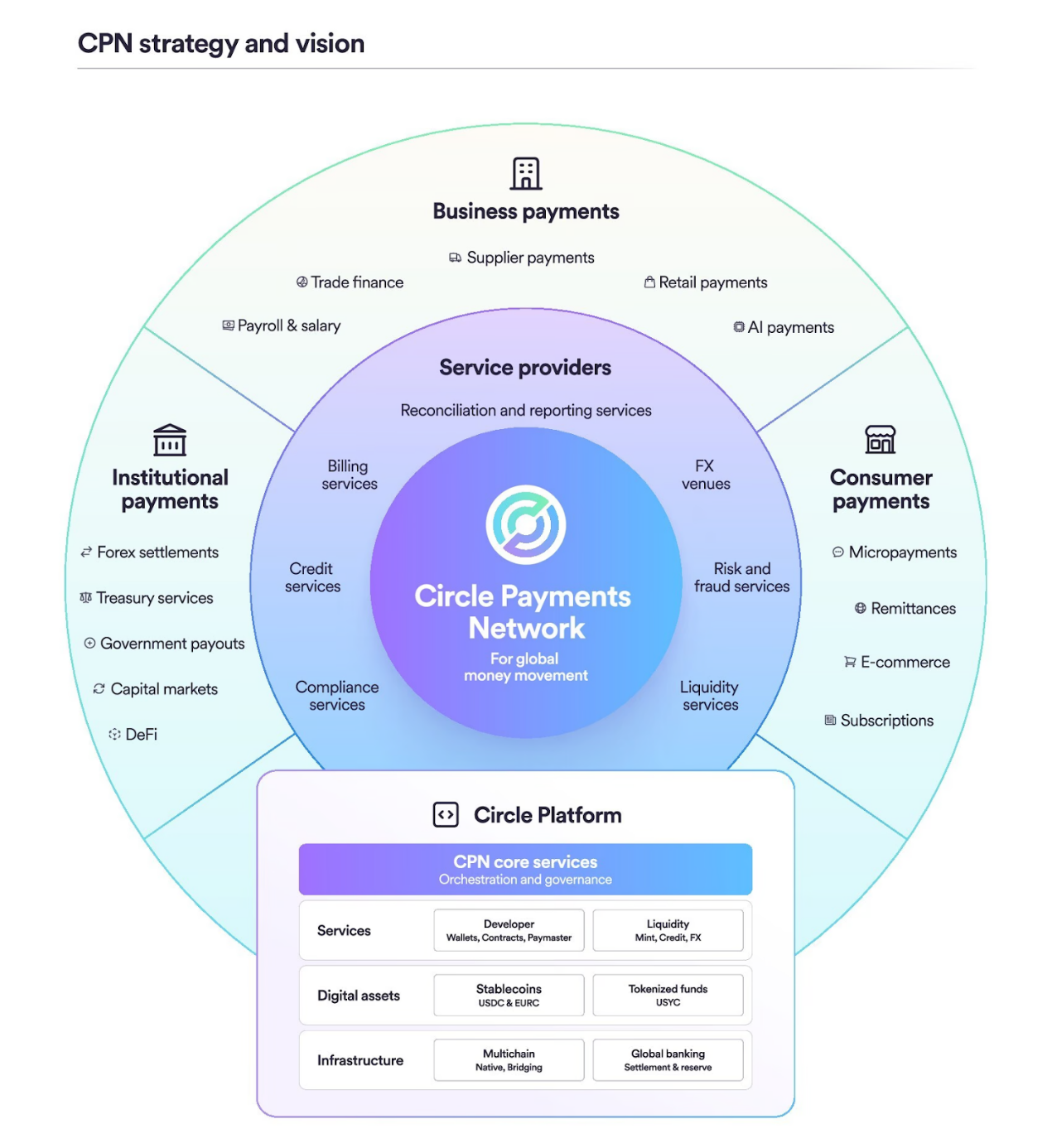

CPN aims to enable faster and lower-cost international remittances by leveraging stablecoins such as USDC, EURC and other regulated digital currencies for 24/7 real-time settlement between participants such as banks, payment providers, virtual asset service providers and digital wallets.

The launch represents a strategic expansion of Circle’s role, from issuer of stablecoins to provider of infrastructure for moving these assets at scale.

Building a framework and removing obstacles

According to World Bank data, the settlement time for cross-border payments may still exceed one working day and the cost may exceed 6%, which has had a certain impact on emerging markets and limited global competitiveness.

Although stablecoins have long been expected to become the new basis for Internet payments and money flows, there are still many obstacles to the adoption of stablecoins in mainstream payments. These obstacles include user onboarding challenges, vague compliance requirements, technical complexities, and concerns about the safe storage of digital cash.

CPN aims to remove these barriers. By integrating financial institutions into a compliant, seamless and programmable framework to coordinate global payments in fiat currencies, USDC and other payment stablecoins. Corporate and individual customers of these financial institutions can enjoy a faster and lower payment experience than traditional payment systems. Financial institutions participating in the network must meet strict qualification criteria, including licensing, AML/CFT compliance, financial risk management and cybersecurity protocols.

Vision and Use Cases

With CPN, Circle is building a new platform and network ecosystem to provide businesses, financial institutions and individuals with a wide range of cross-border capital flow use cases, including supplier payments, remittances, payroll, capital market settlements, internal funding operations, and on-chain financial applications. Among them:

enterprise

Importers, exporters, merchants and large corporations can leverage CPN-enabled financial institutions to eliminate significant costs and frictions, strengthen global supply chains, optimize funding operations, and reduce reliance on costly borrowed working capital.

personal

Remittance senders and recipients, content creators, and other individuals who prefer to send or receive small payments will realize more value, and financial institutions using CPN will be able to provide these improved services faster, at a lower cost, and with greater simplicity.

Builder

Banks, payment companies and other providers can use CPN's platform services to develop innovative payment use cases, build an ecosystem using stablecoins, SDKs and programmability of smart contracts. Third-party developers and businesses can introduce value-added services to further expand network functionality.

In addition, CPN is powered by smart contract infrastructure and modular APIs, enabling third-party developers to build advanced modules, application services, and automated financial workflows directly on CPN.

Meanwhile, to ensure that the CPN is built to high standards of trust and operational integrity, Santander, Deutsche Bank, Societe Generale and Standard Chartered are acting as advisors on the design of the network.

CPN also has more than 20 design partners, including Alfred Pay, BCB Group, BVNK, CoinMENA, etc. This shows that the platform will focus on institutions operating in emerging markets and large remittance channels.

Targeting payment giants

As stablecoins become more popular around the world and regulatory frameworks begin to converge, Circle sees an opportunity to modernize global money circulation.

Circle’s new platform is designed to compete directly with established payment platforms such as Visa and Mastercard. Despite Circle’s growing influence and regulatory scrutiny, USDC still lags behind rival Tether (USDT) in market share.

As of the second quarter of 2025, USDC’s market cap is $60.17 billion, while USDT’s is $144.05 billion. Despite this, Circle is committed to improving transparency, compliance, and functionality to close the gap.

It is also worth mentioning that Circle is not the first company to try to revolutionize cross-border payments or replace SWIFT, but none of them have succeeded so far. It is worth looking forward to whether Circle can break the curse in the future.

Related reading: Circle IPO analysis: Growth potential behind low net profit margin

Ayrıca Şunları da Beğenebilirsiniz

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

The Contrarian Truth: Why Bitcoin and Ethereum Prices Defy Social Media Sentiment