TRON Tops Ethereum in USDT Liquidity, Driving New Wave of Onchain Activity:CryptoQuant

TRON has taken the lead as the dominant network for USDT, overtaking Ethereum in both stablecoin liquidity and user transactions, according to a new report from CryptoQuant.

With a USDT supply now standing at $80.8 billion compared to Ethereum’s $73.8 billion, TRON has become the go-to blockchain for stablecoin transfers, marking a 35% rise since the beginning of 2025.

USDT Activity Shifts to TRON

TRON’s daily USDT transaction count ranges between 2.3 to 2.4 million—around 6.8 times higher than Ethereum’s volume. On a value basis, the network processes over $24.6 billion in USDT per day, more than double that of its rival, reports CryptoQuant.

The firm reports that in the first half of 2025, 98% of the top 10 token transfers on TRON were USDT-related, totaling 384 million transactions. This shift shows not just scale, but TRON’s growing reliability as the infrastructure of choice for dollar-pegged stablecoin transactions.

Network Growth and Gasless Adoption

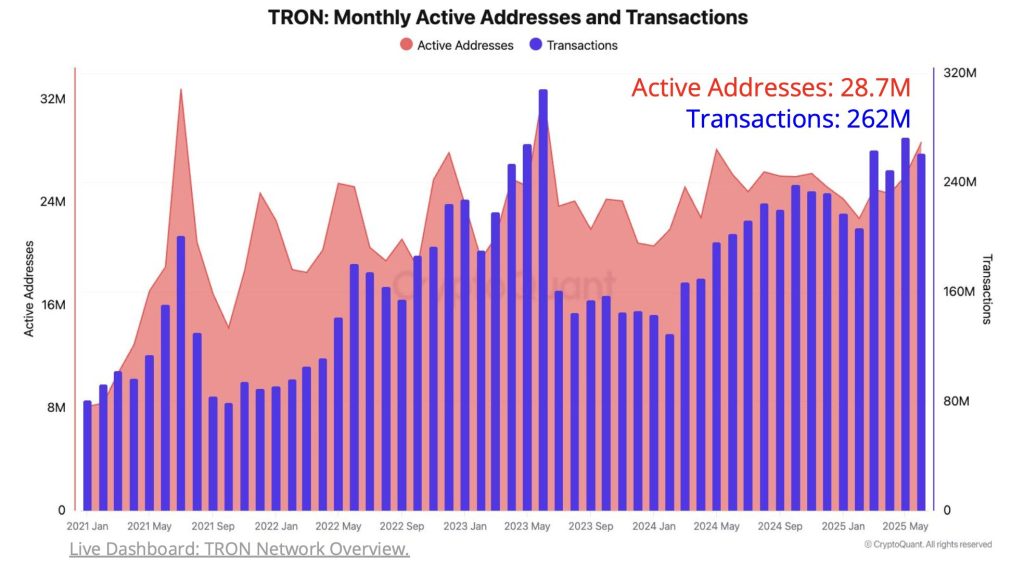

May 2025 saw TRON process 273 million transactions, its second-highest monthly figure ever. June brought further traction with 28.7 million active addresses—the most since mid-2023.

Much of this growth is credited to TRON’s gasless transaction model, which now accounts for 75% of all activity on the network, up from 60% in late 2023. By removing entry costs, TRON continues to attract users looking for frictionless access to onchain services.

DeFi Ecosystem Expands with SunSwap and JustLend

TRON’s decentralized exchange, SunSwap, has also experienced consistent activity throughout 2025, maintaining swap volumes above $3 billion per month and peaking at $3.8 billion in May.

The number of transactions per month also climbed, averaging 516,000—an increase from 316,000 in 2024. Although WTRX still leads swap volumes, its market share has dropped from 98% to 70%, indicating greater use of stablecoins and other assets across the platform.

Lending protocol JustLend is also gaining momentum. Both deposits and borrowing volumes have increased, with USDT and USDD driving activity. Borrowing transactions alone have grown 23% compared to 2024 levels, underscoring a stronger appetite for stablecoin-backed DeFi lending.

Fee Revenue Hits Record High

Despite the surge in fee-free transactions, TRON’s fee revenue hit a new high of $308 million in June 2025. This reflects growing use of advanced, value-added services across the network, particularly in decentralized finance.

The ability to scale gasless usage and earn higher network fees points to a maturing ecosystem with layered activity beyond simple transfers.

TRON’s ascent highlights its role in shaping the next phase of stablecoin utility and onchain finance. With increased liquidity, higher transaction volume, and expanding DeFi services, the network is positioning itself as a long-term competitor in the global digital asset economy.

Stablecoin Market Hits $252B

The first half of 2025 marked a new phase for stablecoins, as their total market supply surged from $204 billion to $252 billion, with monthly settlement volumes reaching $1.39 trillion, CertiK reports.

USDT continues to lead the market in liquidity, particularly on the Tron network, while USDC has narrowed the gap by securing a MiCA license, completing an IPO, and expanding its supply to $61 billion.

Ayrıca Şunları da Beğenebilirsiniz

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

![[OPINION] Honduras’ election turmoil offers a warning — and a mirror — for the Philippines](https://www.rappler.com/tachyon/2025/12/honduras-elections-december-17-2025-reuters.jpg?resize=75%2C75&crop=337px%2C0px%2C1387px%2C1387px)

[OPINION] Honduras’ election turmoil offers a warning — and a mirror — for the Philippines