Institutional investors sold $8.3 billion of stock last week, the second-largest weekly sale on record

Wall Street sold $8.3 billion of stock last week, which is the second-largest weekly sale ever recorded in U.S. history, according to data from Bank of America.

Retail investors stepped in and bought $1.0 billion of stock. That makes five straight weeks of buying from everyday traders. Hedge funds also added exposure. They purchased $1.2 billion, logging their eighth buying week out of the last nine. Big money sold. Smaller players and fast money bought.

Institutions offload US stocks just as dumb money and hedge funds absorb supply

Equity ETFs saw $2.2 billion in inflows during the same week. At the same time, single stock names recorded $8.3 billion in outflows. Investors favored broad funds over individual companies. The gap between ETF inflows and single-name withdrawals was clear.

Single stock outflows have now happened in 13 of the past 15 weeks. Total withdrawals over that stretch equal $52.0 billion. Institutions are selling directly into bids from retail traders and hedge funds. The flow data shows a steady transfer of ownership.

Retail demand after the Supreme Court ruling stayed limited. At 10 a.m. ET, the high court said President Donald Trump wrongly used the International Emergency Economic Powers Act to impose reciprocal tariffs. Traders reacted fast. Major averages jumped, dropped, then recovered within hours.

The Nasdaq Composite is trying to end a five-week losing streak. By midday Friday, the index was up 0.8%. That brought its weekly gain to 1.4%. If it holds, the technology-heavy index will break its longest run of weekly losses since May 2022.

Markets brace for tariffs, Iran risk, and Nvidia results

After the ruling, Trump said he will impose a new 10% “global tariff” using other trade laws. Stocks reacted in stages on Friday.

Tim Holland, chief investment officer at Orion Wealth Management, wrote, “It would seem that Wall Street and Main Street are going to be dealing with the issue of trade and tariffs for some time to come.” Tim focused on the ongoing policy risk facing markets.

The Supreme Court did not address whether importers will receive refunds for tariffs already paid under steeper rates. The issue now returns to the lower courts. Ed Mills, managing director and Washington policy analyst at Raymond James, wrote, “We expect that the process for firms to receive tariff refunds will be lengthy and challenging, with litigants needing to bring individual cases or participate in class action.”

Future tariffs may not be as broad unless Congress provides backing. If inflation eases, the Federal Reserve could gain room to cut interest rates. Traders are also watching geopolitical risk.

Trump will deliver his State of the Union address Tuesday night before a joint session of Congress. Barclays’ trading desk said the speech may include an ultimatum to Iran.

Meanwhile, Nvidia reports earnings on Wednesday, and since the company is one of only two Magnificent Seven names posting a stock gain this year, expectations are high. Analysts want strong revenue and higher forecasts tied to artificial intelligence spending. Cryptopolitan will be reporting the earnings post live on February 25.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.

Ayrıca Şunları da Beğenebilirsiniz

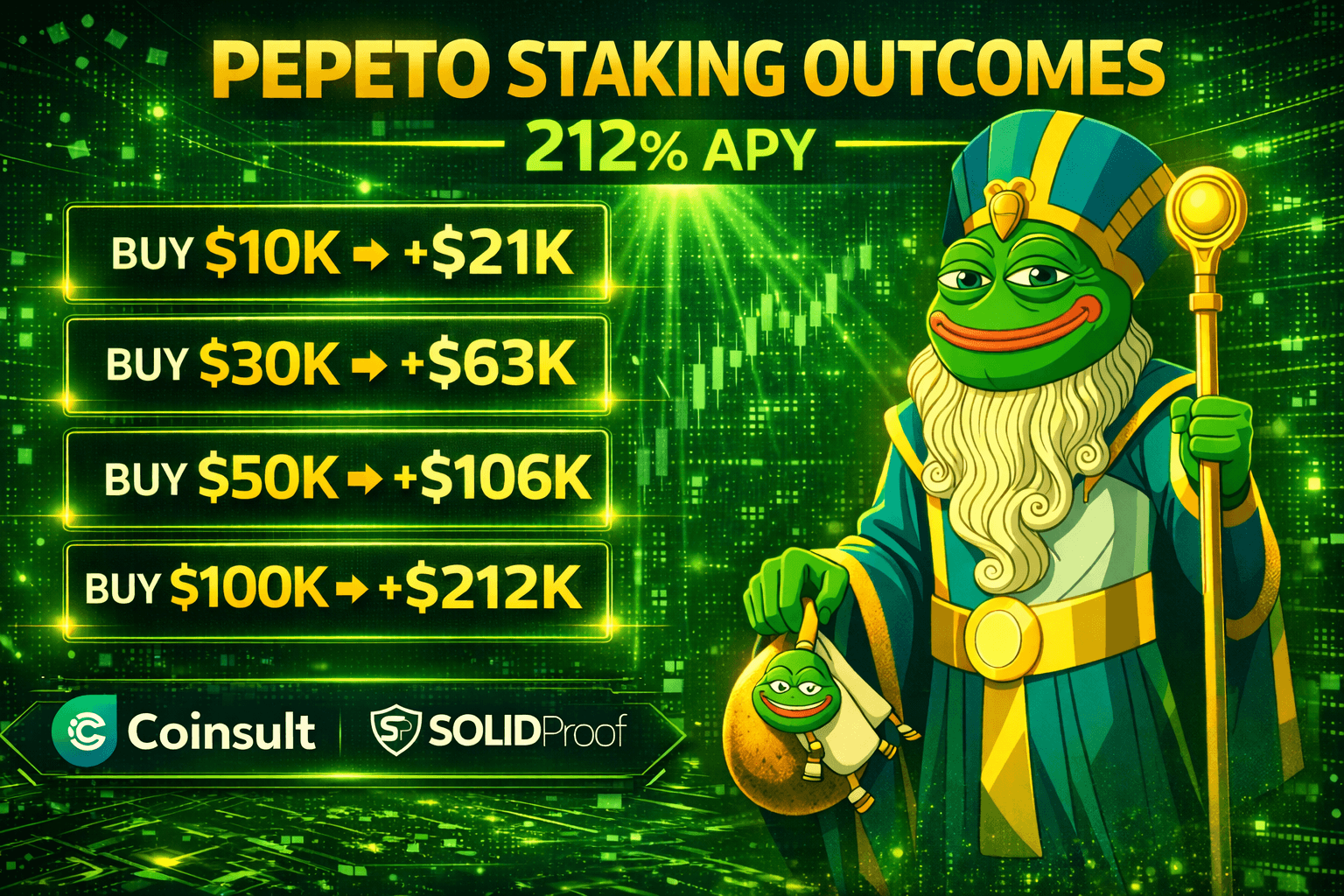

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.