Ether ETFs Smash Records With $1 Billion Single-Day Inflow

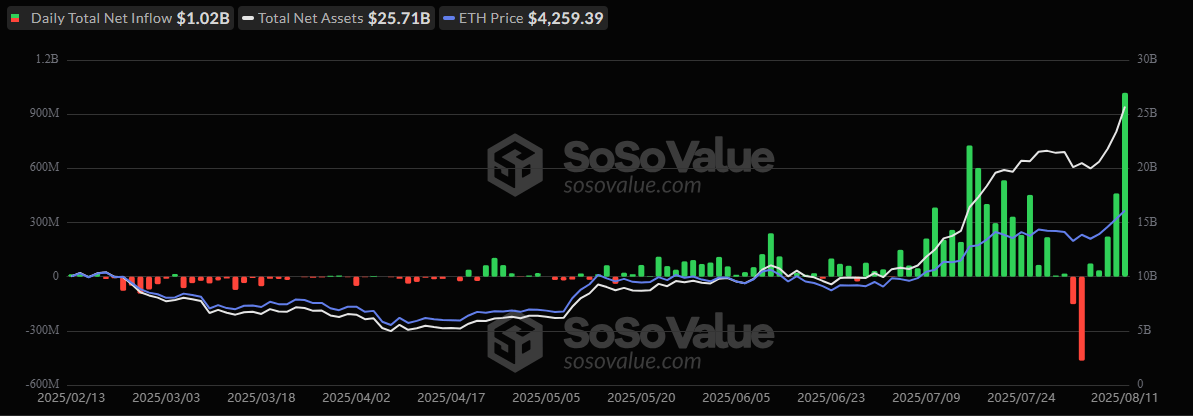

Ether exchange-traded funds (ETFs) posted a jaw-dropping $1.02 billion inflow, their largest single-day entry ever, while bitcoin ETFs maintained momentum with $178 million in net inflows. Both markets saw zero outflows and robust trading activity.

Blackrock Leads $1B Ether ETF Surge As Bitcoin ETFs Extend Gains

Crypto ETF flows lit up the market on Monday, August 11, with a performance that could make history books blush. Ether ETFs didn’t just have a good day; they shattered records with a staggering $1.02 billion in net inflows. Bitcoin ETFs, while not as headline-grabbing, kept the recovery rally alive with a solid $178.15 million gain.

Ether ETFs delivered the true spectacle. Blackrock’s ETHA alone absorbed $639.79 million, while Fidelity’s FETH wasn’t far behind at $276.90 million. Grayscale’s Ether Mini Trust drew in $66.57 million, and ETHE added $13.01 million.

Smaller but notable entries came from Vaneck’s ETHV ($9.42 million), Franklin’s EZET ($4.88 million), Bitwise’s ETHW ($4.30 million), and 21shares’ CETH ($3.86 million). Trading totaled $2.77 billion, pushing net assets to a record $25.71 billion.

Source: Sosovalue

Source: Sosovalue

Bitcoin ETFs also saw green across the board. Blackrock’s IBIT carried the bulk of the inflows at $138.25 million, while Grayscale’s Bitcoin Mini Trust and Fidelity’s FBTC added $14.24 million and $12.99 million, respectively.

Grayscale’s GBTC contributed $7.49 million, and Bitwise’s BITB closed the tally with $5.19 million. No outflows were recorded, with $3.66 billion traded and total net assets climbing to $154.42 billion.

The market takeaway? Institutional appetite for ether has shifted into overdrive, with bitcoin holding steady as the reliable counterpart. If flows like these continue, this week could set the tone for the rest of the quarter.

Ayrıca Şunları da Beğenebilirsiniz

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group