Hyperliquid (HYPE) Price Prediction: Can Bulls Defend $50 or Will Sellers Push Towards $42?

Hyperliquid has returned to a decisive price zone, and participants are closely watching to see whether the $50 handle will hold. After weeks of strength, the pullback has introduced a different tone to HYPE’s chart. Momentum has cooled, and sellers have forced price into critical support where bulls now face their biggest challenge yet.

Hyperliquid Breaks Structure as Bears Take Control

HYPE has slipped into a weaker setup after breaking its recent structure, with the chart showing a clean drop below the support base. The move has opened the door for a bearish retracement, where price could bounce back into the 0.5–0.618 Fibonacci levels around $52 to $54 before facing renewed selling pressure. As long as this zone caps upside attempts, the risk of another leg lower stays in play.

Hyperliquid slips below key support, with sellers pressuring HYPE towards deeper retracement levels. Source: Crypto Chiefs via X

Crypto Chiefs’ analysis leans toward further downside. For bulls, defending the $50 level will be key to avoid deeper trouble, but the structure right now gives the edge to sellers. If momentum continues this way, HYPE could retest its recent lows before any real recovery attempt begins.

Bollinger Bands Holding Critical Support Area

HYPE’s daily chart shows price dropping right into the lower Bollinger Band. The pullback has been steep, with nearly 5% lost on the day, but the alignment of the Bands suggests the market is reaching a point where selling pressure may start to ease. Volume on the decline is notable, which makes this test all the more important for bulls to hold.

HYPE tests its lower Bollinger Band as bulls look to defend the $48–$49 support zone. Source: Big Cheds via X

Analyst Big Cheds highlights that holding the $48 to $49 range will be crucial, as a clean defense here could keep the broader uptrend intact and provide room for recovery.

Hyperliquid Price Prediction

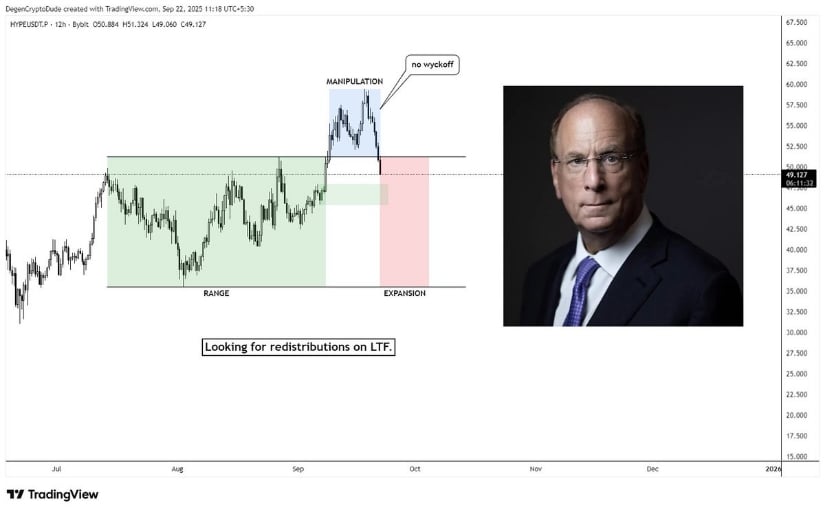

HYPE is now hovering around a key make-or-break zone, with the chart showing a possible PO3 setup forming after an initial run into manipulation territory. The structure highlights how price has fallen back towards the $49 to $50 region. If this breakdown sustains, the consolidation could serve as a base for another leg lower.

Hyperliquid hovers at the $49–$50 zone, with analyst warning of a redistribution setup that could expose $42 and $38 if support fails. Source: Khan via X

Analyst Khan points out that this setup is less of a textbook Wyckoff and more aligned with redistribution mechanics, where sellers could regain control if bulls fail to defend the level. For now, all eyes are on whether HYPE can stabilize around $49 and push back above $52; otherwise, a sustained breakdown could put $42 and even $38 into play as the next important zones.

Can Bulls Negate Emerging Pressure?

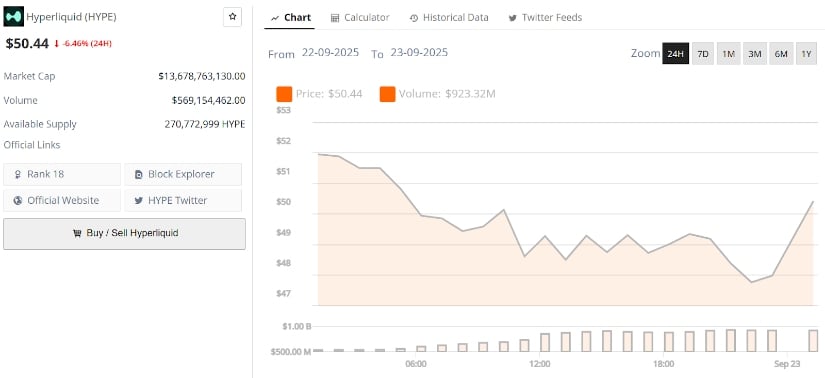

Hyperliquid is trading at $50.44 after a sharp -6.46% dip in the last 24 hours, putting it right back at the critical $50 zone. The daily chart reflects how momentum has cooled, with sellers forcing a retest of lower levels after the recent run. Despite the pullback, liquidity and volume remain stron, over $569M traded in the past day, showing that market participants are still actively positioning around this range.

Hyperliquid’s current price is $50.44, down -6.46% in the last 24 hours. Source: Brave New Coin

The challenge for bulls now lies in countering ASTER’s growing traction, which has diverted attention and capital. If HYPE can defend the $49 to $50 base and reclaim $52 quickly, it may neutralize the short-term pressure and reestablish a path towards higher levels. Failure to hold here, however, would likely see sentiment weaken further, exposing $45 as the next major support.

Ayrıca Şunları da Beğenebilirsiniz

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

ServicePower Closes Transformative Year with AI-Driven Growth and Market Expansion