Ethereum Pectra upgrade adds new features. When will ETH be able to return to $2,000?

By Marcel Pechman , Cointelegraph

Compiled by: Felix, PANews

Ethereum successfully implemented a key network upgrade on May 7, but the price of ETH and its derivatives indicators reacted mutedly to the upgrade. The muted reaction surprised traders and led analysts to question whether ETH still had a chance to rally 22% to reclaim the $2,200 level.

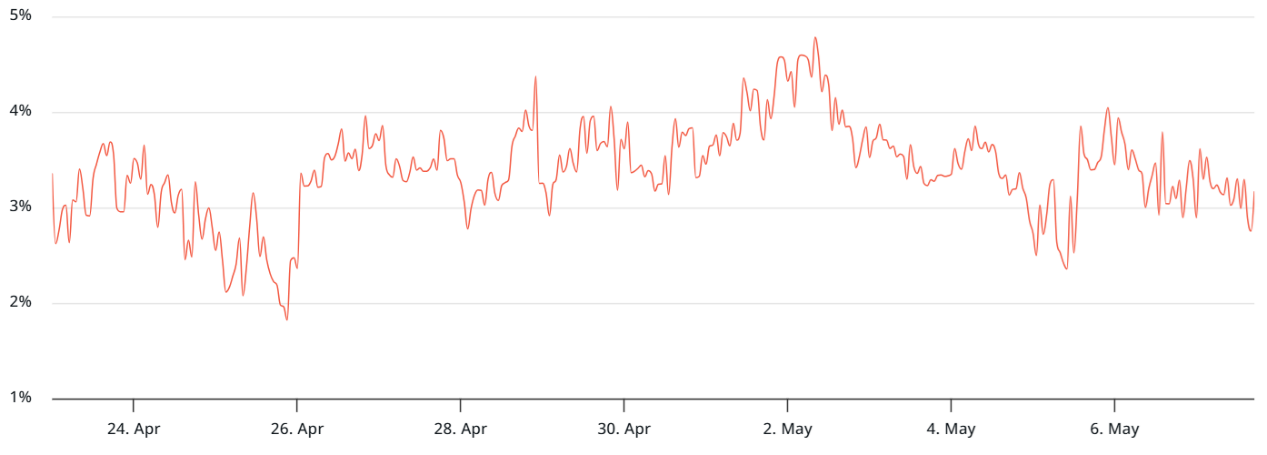

ETH 30 -day futures annualized premium. Source: Laevitas.ch

The ETH futures premium has been below the neutral threshold of 5%, indicating a lack of interest from leveraged longs. More importantly, after the Pectra upgrade, this indicator remained unchanged at 3%, indicating that traders did not adjust their positions despite the successful deployment of the upgrade.

The muted market reaction is partly due to investors’ focus on macroeconomic issues as uncertainty over global trade disputes heightens the risk of a recession. But traders’ lack of interest in ether predates the recent deterioration in risk aversion. In fact, in the first three months of 2025, ETH underperformed the overall cryptocurrency market cap by 28%.

The muted reaction can be attributed in part to investors’ focus on macroeconomic issues, as the risk of a recession is growing amid uncertainty over global trade disputes. But traders’ lack of interest in ETH predates the recent rise in risk aversion. In fact, in the first three months of 2025, ETH underperformed the overall cryptocurrency market cap by 28%.

Pectra’s lackluster price performance following the upgrade reflects a general discontent in the market as other blockchains have shown some momentum.

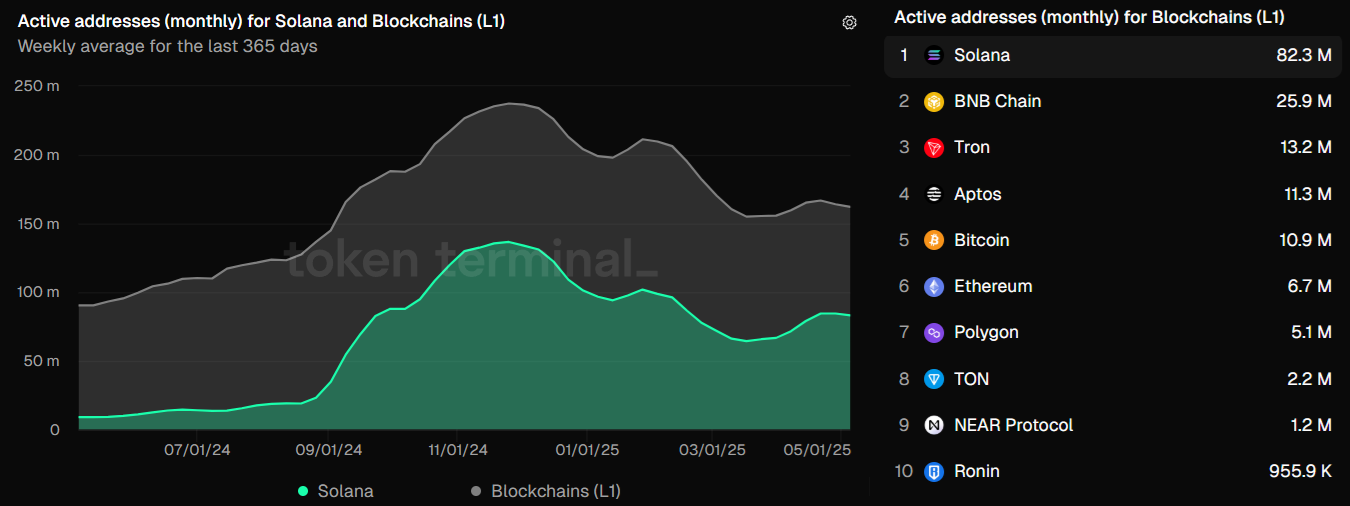

Solana monthly active addresses compared to L1 competitors. Source: Token Terminal

Historically, high Ethereum base layer fees may have limited network activity, but since mid-February, these fees have fallen below $1. In addition, according to Token Terminal data, Ethereum's leading L2 solution Base currently has 10.3 million monthly active users, far less than Solana's 82.2 million and BNB Chain's 25.9 million.

Ethereum lags in DApp interoperability — will this affect ETH’s price?

Solana has dominated the DEX space by providing an integrated user experience, especially in token issuance. Similarly, Hyperliquid has outperformed expectations in perpetual contract trading, indicating that traders' main concerns are not necessarily on Ethereum's decentralization and security. Meanwhile, Tron has made significant progress in the stablecoin market.

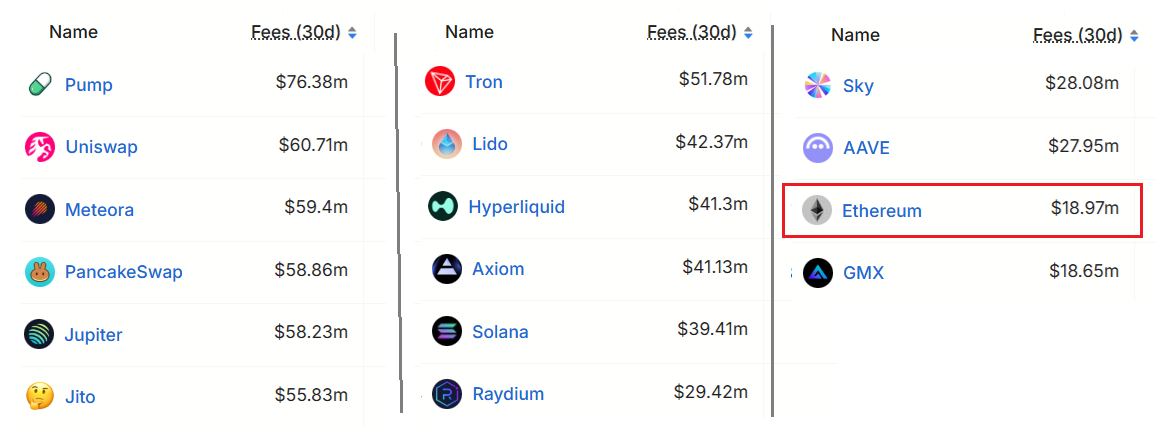

Blockchain and DApps 30 -day fees (in USD). Source: DefiLlama

Ethereum still leads in terms of total locked value (TVL) at $53.7 billion. However, this has not brought much benefit to ETH holders. According to DefiLlama data, Ethereum network fees have been relatively low at only $19 million in the past 30 days. In comparison, Tron has accumulated fees of $51.8 million in the same period, while Solana has accumulated fees of $39.4 million.

Source: X/ProbablyNoam

Noam Hurwitz, Alchemy’s head of engineering, noted that Ethereum’s blob fees have dropped to their lowest levels since the Pectra upgrade. For Hurwitz, ETH’s success depends on the scalability of the base layer, including further improvements to the Rollup mechanism, and ultimately a more seamless user experience.

The interoperability of assets and data in the Ethereum L2 ecosystem has long been a problem, while users on the Solana and BNB chains can easily switch between multiple decentralized applications (DApps). Although the Pectra upgrade is a step in the right direction, it still does not solve this problem, which also explains why ETH has not been able to return to the $2,200 level in early March.

For the price of ETH to rise 22% from its current $1,810, investors will likely need assurance that progress on the network (whether through deposits or L2 growth) translates into noticeable returns. Ultimately, higher staking yields or stronger incentives will be needed to drive wider adoption of DApps, which in turn will increase demand for ETH within the ecosystem.

Related reading: Dialogue with the Ethereum Foundation: After the Pectra upgrade, the three core strategies for the future are explained in detail

Ayrıca Şunları da Beğenebilirsiniz

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Zakt de Bitcoin koers naar $80.000 na de $3 miljard BTC ETF uitstroom sinds november?