Ethereum Price Steadies After Shakeout, On-Chain Data Shows Deep Buy Walls

After briefly dipping near $3,150, ETH recovered toward $3,190 on Thursday, with traders pointing to improving structural support, stabilizing ETF flows, and signs that sellers are losing strength.

- Ethereum is holding major support at $3,150 and $2,800.

- ETH/BTC reclaimed its 20-day MA, easing bearish concerns.

- $177M in ETH liquidations hit the market but did not break support.

- ETH ETFs saw renewed inflows on December 10.

The latest data from Glassnode shows that two large cost-basis clusters continue to act as major buffers. Roughly 2.8 million ETH were accumulated around $3,150, while an even larger pocket of 3.6 million ETH sits near $2,800, forming what on-chain analyst Ali Martinez described as Ethereum’s “strongest defensive zones” in months. These liquidity concentrations suggest that a significant number of market participants remain in profit and are willing to defend these levels.

Analysts View ETH/BTC Structure as Constructive

Market analysts also appear increasingly confident that Ethereum may be nearing the end of its corrective phase. Crypto expert Michaël van de Poppe noted that the ETH/BTC pair reclaimed its 20-day moving average for the first time in weeks, a technical shift he interprets as a sign of regained momentum.

He argued that the deeper pullback seen earlier in December did not invalidate Ethereum’s broader uptrend and instead allowed the market to reset overheated indicators. According to van de Poppe, the structure “isn’t a bearish chart,” and the pair holding above its short-term trendline suggests ETH may attempt a gradual rebound once the market digests recent macro events.

A look at the ETH/USDT 4-hour chart reinforces the same picture. The RSI cooled from overbought territory and is now stabilizing around the neutral zone near 49, reflecting reduced downside pressure. Meanwhile, the MACD remains in a mild bearish crossover but shows shrinking negative momentum, indicating sellers are losing control. Combined, the indicators point to consolidation rather than a trend breakdown.

Liquidations Spike but Demand Remains

The recent move generated a wave of leveraged unwinding across derivatives markets. Over the past 24 hours, $177 million in ETH positions were liquidated, with approximately $125 million in long positions taken out and $51 million in shorts also wiped out.

READ MORE:

Ripple Stablecoin RLUSD Expands as Gemini Adds XRPL Support

Despite the liquidation pressure, Ethereum continues to attract sufficient spot demand to offset aggressive leverage resets. Many traders interpreted the flush as healthy cleansing rather than a signal of deeper weakness.

One of the strongest signs of resilience came from ETF data. After alternating inflows and outflows throughout late November and early December, U.S. Ethereum ETFs finally posted renewed strength. On December 10, spot and staking-enabled products recorded a collective $56.5 million of inflows, reversing multiple sessions of red. Products from BlackRock, Bitwise, and VanEck all contributed to the rebound, helped by improving sentiment following the recent Federal Reserve rate cut.

The broader ETF pattern remains mixed—several funds saw significant withdrawals earlier this month, such as Grayscale’s ETHE and EZETH products—but the return of net positive flows suggests investors are re-entering the market cautiously rather than retreating.

What Comes Next for Ethereum?

With macro uncertainty still elevated, traders are watching whether ETH can hold above the $3,150 on-chain support block. A clean move above $3,250 would likely attract momentum traders back into the market, while a failure to defend $3,150 could expose Ethereum to a retest of the deeper liquidity pocket near $2,800.

For now, most analysts agree on one point: Ethereum is not showing the technical or on-chain deterioration typically associated with the start of a bearish trend. Instead, the market appears to be digesting leverage, recalibrating risk, and preparing for its next directional move as 2025 draws to a close.

The post Ethereum Price Steadies After Shakeout, On-Chain Data Shows Deep Buy Walls appeared first on Coindoo.

Ayrıca Şunları da Beğenebilirsiniz

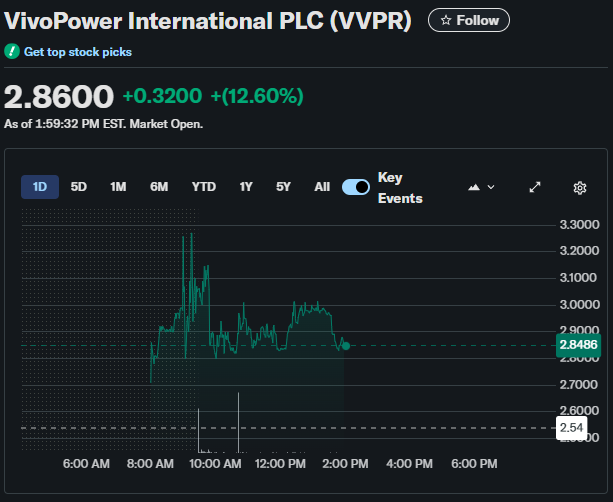

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally

Milk Mocha’s 40-Stage Presale Explained