Explosive Aave DAO Proposal Aims to Seize Control of Aave Labs’ IP and Equity

BitcoinWorld

Explosive Aave DAO Proposal Aims to Seize Control of Aave Labs’ IP and Equity

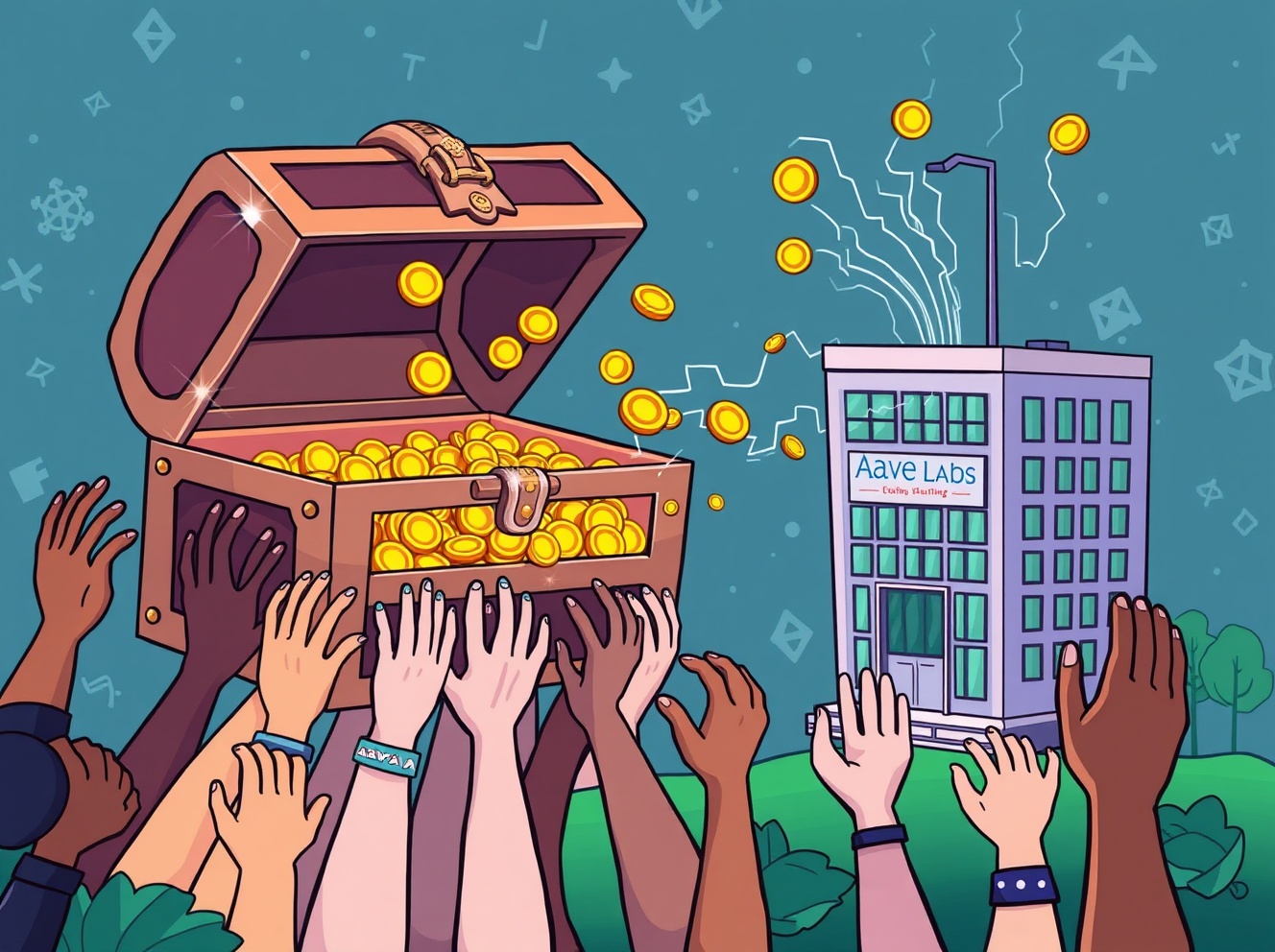

A seismic shift is brewing within one of DeFi’s giants. An explosive new Aave DAO proposal has ignited fierce debate, aiming to fundamentally reshape the relationship between the decentralized autonomous organization and its founding development team. This move could see the DAO absorb the intellectual property and equity of Aave Labs, effectively turning the original creator into a subsidiary.

What Does This Explosive Aave DAO Proposal Actually Demand?

The proposal, framed by some as a ‘poison pill’, is a direct response to growing internal conflict. It lays out a radical new structure. Therefore, its core demands are clear and transformative:

- Full Absorption: The Aave DAO would take ownership of Aave Labs’ intellectual property and company equity.

- Subsidiary Status: Aave Labs would become a formal subsidiary entity of the DAO.

- Revenue Redirection: All revenue generated by Aave Labs from the Aave brand and protocols must flow directly into the DAO treasury.

This Aave DAO proposal didn’t emerge in a vacuum. It follows allegations that swap fees from a front-end interface were being sent to an Aave Labs address instead of the communal treasury, highlighting a critical tension over value capture.

Why Is This Aave DAO Governance Fight So Intense?

At its heart, this conflict is about power, money, and the very soul of decentralized governance. For years, a delicate balance existed between the innovative builders at Aave Labs and the token-holding community that governs the protocol. However, this balance is now under severe strain.

The central question is: who rightfully controls and profits from the value created by the Aave ecosystem? Proponents of the Aave DAO proposal argue that value should accrue to the collective that secures and governs the network. Conversely, others worry that stripping the core development team of its assets and incentives could cripple future innovation.

What Are the Potential Outcomes of This DAO Power Struggle?

The path forward is fraught with challenges and opportunities. If the community passes this Aave DAO proposal, it would set a monumental precedent in DeFi. The DAO would gain unprecedented control over its brand and technology stack. Moreover, it would secure a direct revenue stream to fund grants, incentives, and further development.

Yet, the risks are equally significant. Aave Labs could resist the move, potentially leading to legal battles. The team’s motivation might plummet if their equity is dissolved. Furthermore, such a hostile takeover could scare away other talented developers from building within the DAO framework, fearing a similar fate.

Conclusion: A Defining Moment for Decentralized Governance

This explosive Aave DAO proposal is more than an internal dispute; it’s a stress test for the entire DAO model. It forces the community to answer difficult questions about ownership, alignment, and sustainability. The outcome will send a powerful signal to the wider crypto world about where true power lies in a decentralized ecosystem—whether it remains with founding entities or is fully transferred to token-holding communities. The decision will undoubtedly shape the future of Aave and influence governance debates across DeFi.

Frequently Asked Questions (FAQs)

Q1: What is Aave DAO?

A: Aave DAO is the decentralized autonomous organization that governs the Aave lending protocol. AAVE token holders vote on proposals to manage the protocol’s treasury, parameters, and development.

Q2: What is Aave Labs?

A: Aave Labs is the original development company that created the Aave protocol. It has historically been a key contributor, but operates as a separate legal entity from the DAO.

Q3: What does ‘absorb IP and equity’ mean in this proposal?

A: It means the Aave DAO would legally own Aave Labs’ intellectual property (like code and brand trademarks) and any company shares (equity), making Aave Labs a owned subsidiary.

Q4: Why is this called a ‘poison pill’ proposal?

A: In corporate finance, a ‘poison pill’ is a defensive tactic to make a company less attractive for a takeover. Here, the term is used to describe an aggressive proposal that could drastically alter Aave Labs’ structure, possibly as a defensive move by the DAO.

Q5: What happens if the Aave DAO proposal passes?

A: If passed, Aave Labs would become a subsidiary, all its Aave-related revenue would go to the DAO treasury, and the DAO would have direct ownership of its core assets. Implementation would likely involve complex legal processes.

Q6: How can AAVE token holders vote on this?

A: The proposal is currently in the ‘temperature check’ discussion phase on the Aave governance forum. If it gains sufficient support, it will move to a formal on-chain vote where AAVE holders can stake their tokens to vote.

What’s your take on this power struggle? This landmark Aave DAO proposal will redefine decentralized governance. Share this article on Twitter or LinkedIn to spark a discussion with your network about who should control value in the DeFi ecosystems we build.

To learn more about the latest DeFi governance trends, explore our article on key developments shaping DAO structures and their impact on future protocol innovation.

This post Explosive Aave DAO Proposal Aims to Seize Control of Aave Labs’ IP and Equity first appeared on BitcoinWorld.

Ayrıca Şunları da Beğenebilirsiniz

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.