Bitcoin Crashes Below $90K as $520M Liquidations Hit, On-Chain Data Hint Deeper Crash

The post Bitcoin Crashes Below $90K as $520M Liquidations Hit, On-Chain Data Hint Deeper Crash appeared first on Coinpedia Fintech News

Bitcoin price today fell below $90,000, wiping nearly $170 billion from the crypto market in just one day. But this crash is only the beginning of a bigger problem. Weak liquidity, negative on-chain signals, and the Federal Reserve’s latest decision are all adding more pressure.

All these signs together raise concerns about whether the market is preparing for a deeper fall.

Fed’s Latest Rate Cut Led Market Drop

Bitcoin faced sharp selling as traders responded to the Federal Reserve cutting rates by 25 bps, but then delivered a surprise message.

Fed Chair Jerome Powell said there may be no more rate cuts before the January 2026 meeting. This bearish tone pushed risk assets lower, driving Bitcoin toward the $89,000 zone.

On top of that, the Fed announced it would buy $40 billion in Treasury bills within 30 days, a move it claims is not “money printing,” but experts say it shows stress in the money market.

This pressure pushed gold prices higher and made investors pull money away from riskier assets like crypto.

Crypto Market Crashes as Liquidation Reaches $520 million

As fear spread, the total crypto market cap dropped from $3.24 trillion to $3.07 trillion in a few hours. The Crypto Fear & Greed Index also fell to 29, showing strong fear among traders.

The crash triggered massive liquidations worth more than $520 million in 24 hours. Around $379 million came from long positions alone, meaning traders betting on rising prices were wiped out.

However, Bitcoin options worth $3.56 billion are also expiring tomorrow. The put/call ratio of 1.09 shows many traders are positioning for more downside.

On-Chain Indicators Show Bears in Control

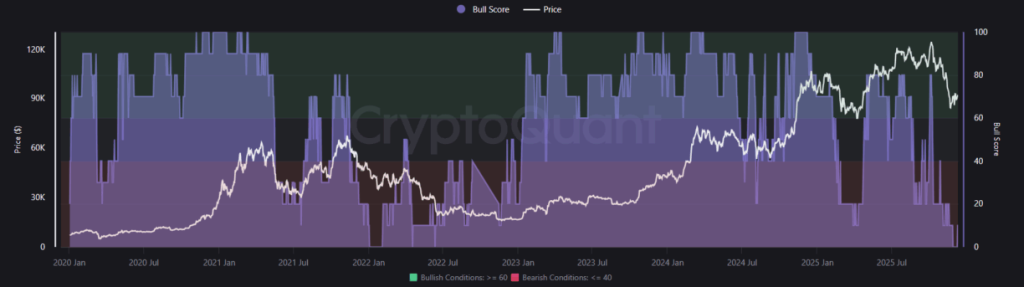

On-chain data show rising pressure. Cryptoquant data shows that the Bitcoin Bull Score fell back to 0, showing extreme bearish sentiment.

Meanwhile, realized losses are now at -18%, still far from the historical “buy zone” of -37%.

Interestingly, about $6 billion worth of short positions are at risk. If Bitcoin suddenly jumps to $100,000, these shorts will be liquidated, causing a “domino effect” that could send prices soaring.

Bitcoin Struggles Below $95K, Holds Key $90K Support

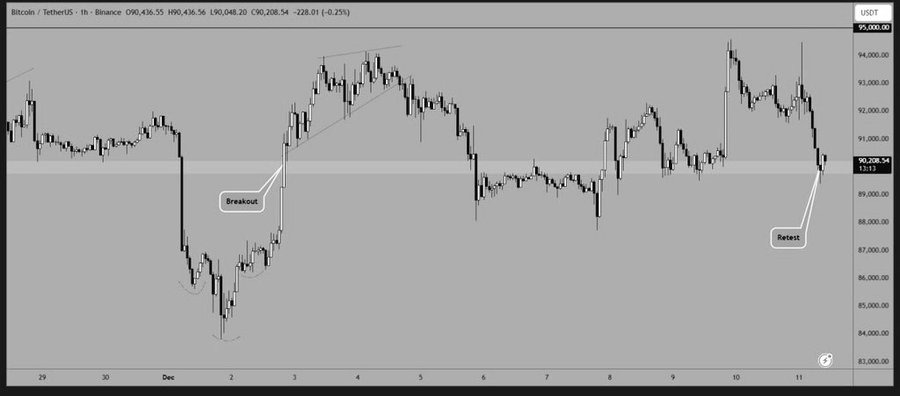

Further analysis the bitcoin chart, Crypto trader Crypto Palace added more pressure to the discussion with a fresh chart breakdown.

According to him, Bitcoin once again failed to break through the tough $95,000 resistance, and right after the Fed’s rate-cut news, the market reacted with a sharp pullback.

BTC is now retesting the $90,000 zone, which has turned into a major short-term support.

However, staying above this level keeps the bullish structure alive, but a daily close below it could open the way to deeper declines toward $87,000.

Ayrıca Şunları da Beğenebilirsiniz

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Why Investors Prefer Tether Gold (XAUT) Instead of Physical Gold