Manipulation? Bitcoin Drops $2,000 in 35 Minutes, $132M Longs Liquidated

Bitcoin BTC $90 176 24h volatility: 1.3% Market cap: $1.80 T Vol. 24h: $69.71 B lost $2,000 in its price as the US market opened on Friday, Dec. 12, causing over $132 million in long position liquidations, according to an analyst. This is a similar price action the leading cryptocurrency has seen repeated a few times, raising concerns of market manipulation from big institutional players.

In particular, Bull Theory called it the “10am manipulation,” pointing to a previous post from December 8 where he explained the phenomenon and credited zerohedge as another source that is also calling out this suspect behavior.

As the analyst explained “the pattern is too consistent to ignore,” with BTC dropping aggressively in the first few minutes past 10:00 a.m. EST, when the US market opens, and gradually recovering in the following hours. “The same thing happened in Q2 and Q3,” Bull Theory said.

The main suspect, per his analysis, is Jane Street, described as “one of the largest high-frequency trading firms in the world,” with “the speed and liquidity to move markets for a few minutes.” Notably, the firm has been accumulating IBIT, BlackRock’s Bitcoin Spot ETF, currently holding circa $2.5 billion of the asset for what is Jane Street’s fifth-largest position.

Bitcoin Price Analysis Amid Suspected ’10am Manipulation’

As of this writing, Bitcoin was trading at $90,400, slowly recovering from the drop as reported.

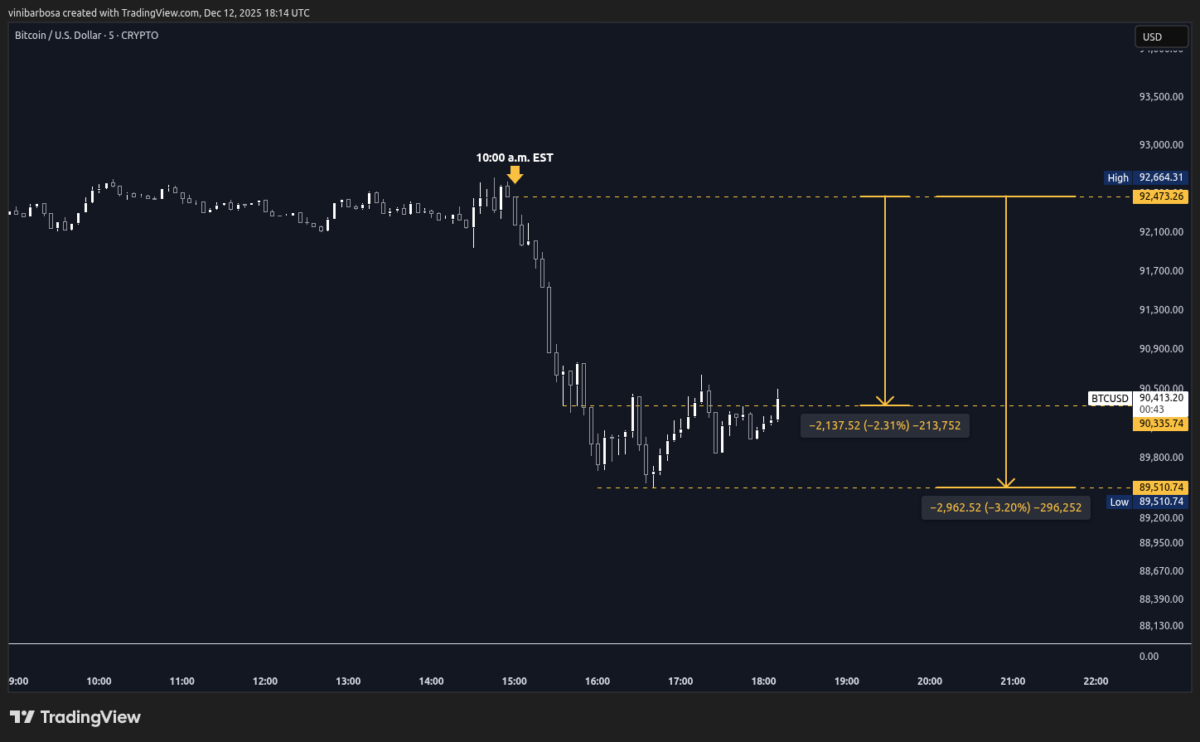

Following the pattern Bull Theory identified, BTC went from $92,473 down to $90,335 in the first 35 minutes past 10:00 a.m. EST. Bitcoin continued its way down in the next few minutes, trading as low as $89,510 between 11:35 and 11:40 a.m. EST.

The first drop was, as the analyst highlighted, a $2,137 dip, with 2.31% in accumulated losses from the US market opening. From the pre-market price to its lowest point on the day, Bitcoin lost 3.2%, or nearly $3,000 in nominal value.

Bitcoin (BTC) five-minute price chart, as of December 12 | Source: TradingView

Before that, Bitcoin was showing signs of strength as the United States Congress pushed the SEC to allow crypto in 401(k) plans, trading above $92,000, as Coinspeaker reported. Ethereum ETH $3 070 24h volatility: 4.7% Market cap: $370.75 B Vol. 24h: $28.41 B and other cryptocurrencies were following the leader into a potential bullish reversal despite ETH ETF outflows that suddenly got invalidated as soon as the so-called “10am manipulation” pattern played out.

While market manipulations are difficult to prove, the repeated pattern may serve as a cautious warning to BTC traders—especially the bulls willing to open long positions. This is because long positions could become targets for the whales that may use these liquidations as fuel for long squeezes and accumulation at lower prices, earning better entries than retail.

nextThe post Manipulation? Bitcoin Drops $2,000 in 35 Minutes, $132M Longs Liquidated appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

TrendX Taps Trusta AI to Develop Safer and Smarter Web3 Network

Nvidia wants to boost H200 chip production to appease China